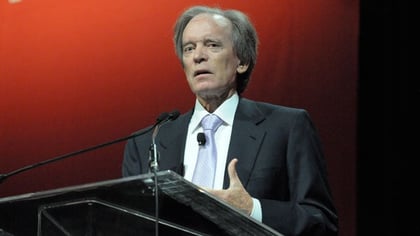

Investors pulled money from Bill Gross’ bond fund for the fifth consecutive month in July, reducing assets to the lowest since November 2014, less than two months after he took over the go-anywhere pool.

The Janus Henderson Global Unconstrained Bond Fund suffered more than $200 million in redemptions last month, according to Bloomberg estimates. That helped lower the fund’s assets to $1.25 billion compared with February’s all-time high of $2.24 billion.

(Related: Bill Gross’ Slumping Fund Sees $580 Million of Outflows This Year)

Gross has piled up year-to-date losses of 7 percent, one of the toughest slumps in a storied career that dates to 1971, when he co-founded Pacific Investment Management Co. The decline was attributed in part to a misplaced bet that rates on U.S. Treasuries and German bunds would converge, a position the fund later scaled back.

August 08, 2018 at 04:32 PM

August 08, 2018 at 04:32 PM