The biggest difference between a self-made billionaire and a mere millionaire is more complex than net worth. It’s the billionaire’s rare mindset driven by an extraordinary love of work and superior work ethic versus the millionaire’s lone uber-goal of achieving a life of personal luxury, global entrepreneur Rafael Badziag tells ThinkAdvisor in an interview.

An expert in the psychology of entrepreneurship, he discusses several key principles shared by billionaires as well as specifics that five of the world’s most accomplished billionaires revealed to him in face-to-face interviews.

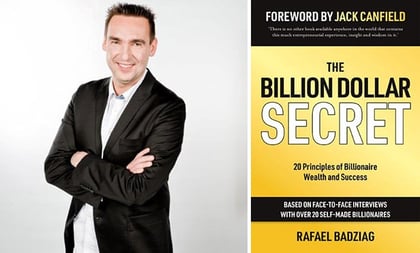

In his new book, “The Billion Dollar Secret: 20 Principles of Billionaire Wealth and Success” (Panoma Press- June 12, 2019), Badziag reports on what he learned from the 20 global self-made billionaires who sat down to chat.

They include Peter Hargreaves, founder and chair of Hargreaves Lansdown, the largest retail investment platform in the U.K., according to Badziag; Tim Draper, legendary venture capitalist; and Naveen Jain, a former Microsoft software engineer, who founded Intelius, among other big companies, and whose Moon Express is focused on private space exploration.

In the interviews, Badziag discovered several traits common to self-made billionaires’ approach to business, including: Billionaires are non-conformists; billionaires work not for the money but because they love their business or industry; billionaires’ notion of success means being willing to take risks — but smart ones.

Germany-based Badziag, 46, is an angel investor and popular TED speaker. He created Germany’s first online bike shop, then expanded into a variety of Internet-based businesses in several other countries.

ThinkAdvisor recently interviewed the entrepreneur, on the phone from Stuttgart. Reveals the author: “I’m not a billionaire. I’m a humble millionaire.”

Here are highlights of our interview:

THINKADVISOR: What’s one major difference in risk approach between a billionaire and a millionaire?

RAFAEL BADZIAG: Billionaires take risk with a limited downside and unlimited upside. They never bet the farm. Millionaires take risk but with a limited upside. They’re not really proficient at handling risk. So they’ll either take risk with limited upside, or they’ll bet the farm and lose everything.

What’s another big differentiator?

Billionaires [work exceptionally hard] not for the money but because they love the industry or their business itself. Millionaires generally earn money to spend money because they want to improve their private lives. They’re motivated by personal luxury.

That isn’t bad, is it?

But that motivation stops them at a certain level. You don’t see much improvement in your private life if you go from $25 million to $35 million. So you lose the motivation to grow.

What happens then?

The business usually suffers and stagnates. You may lose it because you stop developing and get beaten by your competition.

One really has to think big, then, to become a billionaire. Right?

Yes. Billionaires are willing to sacrifice years of their life, maybe their entire life, for something that may fail. The level of their commitment for decades is [off the charts].

But don’t they need to have exceptional talent in the first place?

Yes, though those qualities aren’t inborn. They’re developed during life through experiences, attitudes and habits. Also, along the way, billionaires identify their weak points and improve or develop them.

What’s another outstanding characteristic of billionaires?

They go their own way even when people tell them they’re wrong. Billionaires don’t conform and generally don’t care that much about what others think of them. They’re not out there for getting good publicity or being liked by many people. They have the approach that doing the right thing is much more important — even at the price of being unpopular or maybe losing a job.

Tell me about some of the billionaires you’ve interviewed. Start with Peter Hargreaves, whose financial services firm, Hargreaves Lansdown, with AUM of $120 billion, is the largest retail investment platform in the U.K., you write. He said a business has to make it easy for people to buy: in his case, moving money to investments that the firm offers.

Peter is a great salesperson. One of the keys to good sales is to make it as easy as possible for your customers. So investment customers on his platform can have their banking accounts on the same platform.

You write about Hargreaves’ frugality and how it’s helped him in business. Right after World War II, his father, who owned a small grocery in the U.K., watched every penny.

Peter’s company has never borrowed any money; never had any debt. Even privately, he has no debt. He’s one of the most economically living billionaires I know. He said he spends only a small percentage of the money he makes. When I interviewed him, he was driving a 7-year-old Toyota Prius. He flies economy class. He’s still wearing a pair of shoes he bought 10 years ago for about $35.

July 11, 2019 at 04:15 PM

July 11, 2019 at 04:15 PM