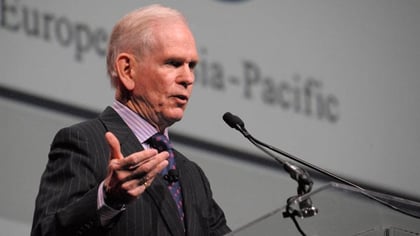

After hearing Grantham Mayo Van Otterloo co-founder Jeremy Grantham’s keynote on Tuesday at the 2018 Morningstar annual conference in Chicago, there is no doubt RIAs in the audience were persuaded to utilize sustainable investing methods. Grantham, who said 98% of his net worth was invested in or committed to environmental foundations, gave a sobering speech on where the world was at in its “decay,” and what was needed to change it. “We’ve created a toxic world,” he said.

Aside from highlighting the research on global warming, Grantham illustrated several dangers specifically to agriculture, including severe loss of top soil in the U.S. Midwest due to increased downpours that wash it away, as well as the problems caused by pesticides — rivers polluted with runoff and flying insects killed off, leaving crops with fewer pollinators.

“We only have 30 to 70 good agricultural producing years left” at the rate we are going, he said, adding that the world is losing 1% of collective soil and 1% of arable land a year.

Some other findings he cited:

- Global population has tripled since 1938, but fertility rates are declining. Sperm count has dropped 50% in the developed world. “Two factors may be people are waiting longer to have kids, and all the toxicity in the world,” he said.

- Since 1950, floods happen 15 times more often, wildfires seven times more often and extreme temperature events over 20 times often. Since 1996, droughts happen 10 times more often.

- There has been a significant rise in certain diseases, including diabetes, asthma, autism and MS; in addition, several types of cancers have risen dramatically since 1953, including melanoma, breast and testicular cancer.

The good news is clean energy, specifically solar and wind, will be much cheaper in the next 10 years than even the operating costs of coal and nuclear power. Battery costs will drop as well, making electric cars cheaper to build, run and maintain. The problem, Grantham said, is carbon will continue to increase even as green measures are taken and fossil fuel use drops, and we can only afford a rise of 3 degrees celsius.

June 13, 2018 at 01:48 PM

June 13, 2018 at 01:48 PM