Fewer U.S. taxpayers are reporting help from a key Affordable Care Act health insurance subsidy on their income tax returns this year —but, for the people who are using the subsidy, the average amount has grown.

- The number of taxpayers who say they used ACA premium tax credit help in 2017 fell 9%, to 1.5 million.

- The total amount of accurate, and inaccurate, premium tax credit help paid to insurers increased 20%, to $7.7 billion.

- The average subsidy amount per subsidy user increased 35%, to $4.5 billion.

Officials at the office of the Treasury Inspector General for Tax Administration (TIGTA) have included those figures in a new batch of preliminary tax return data for the 2017 benefit plan year and the 2018 tax filing year. TIGTA officials used data from the day the tax filing season started, on Jan. 29, through March 1.

(Related: ACA Definitions: Enrollment Period Basics)

A copy of the new data is available here.

The total number of consumers filing tax returns held steady at about 61 million.

For the 572,705 taxpayers who received too little help from the subsidy program, the average amount due from the program increased 15%, to about $530 per taxpayer.

For the taxpayers who received too little subsidy help, the average amount owed to the government increased 11%, to $655.

The number of taxpayers who admitted to owing the “individual shared responsibility” penalty thta the ACA imposes on people who fail have what the government classifies as solid major medical coverage fell 17%, to 4.4 million.

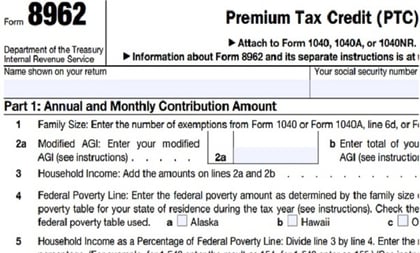

A Subsidy Refresher

April 11, 2018 at 05:08 AM

April 11, 2018 at 05:08 AM