The Federal Reserve released the minutes of the Federal Open Market Committee’s (FOMC’s) November 2-3 meeting Tuesday.

The Federal Reserve released the minutes of the Federal Open Market Committee’s (FOMC’s) November 2-3 meeting Tuesday.

The minutes indicated that the New York Fed reinvested $65 billion of principal payments from the System Open Market Account (SOMA’s) “holdings of agency debt and agency- guaranteed mortgage-backed securities (MBS),” into longer-term Treasury securities, mostly in 2- to 10-year maturities—including some TIPS—as part of an initiative announced in August. The FOMC minutes note that the Treasury estimates that it could reinvest about $75 billion a month in this way without disrupting the market.

The Economy

As for the economy, the report noted that, “economic recovery proceeded at a modest rate in recent months, with only a gradual improvement in labor market conditions, and was accompanied by a continued low rate of inflation.” There were “gains” in “consumer spending, business investment in equipment and software, and exports,” but construction—both residential and commercial—was still “depressed.”

The report also said, “U.S. industrial production slowed noticeably in August and September, hiring at private businesses remained modest, and the unemployment rate stayed elevated.”

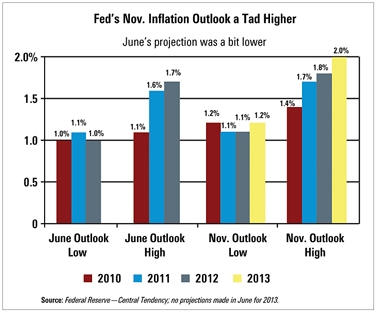

Headline inflations was “subdued” and “core consumer price inflation trended lower.”

“Real personal consumption expenditures (PCE) rose” moderately—attributed to “rising equity prices,” in the stock market, but “real disposable income” was up “only slightly in the third quarter,” after jumping in the first half of the year, and the savings rate dropped, though it is still high, as it has been since 2008, the report indicated.

November 23, 2010 at 10:01 AM

November 23, 2010 at 10:01 AM