What You Need to Know

- One target: New investment indexes designed to have unrealistically high historical returns.

- Another target: Vagueness about the ability of the issuer to change index return caps and floors.

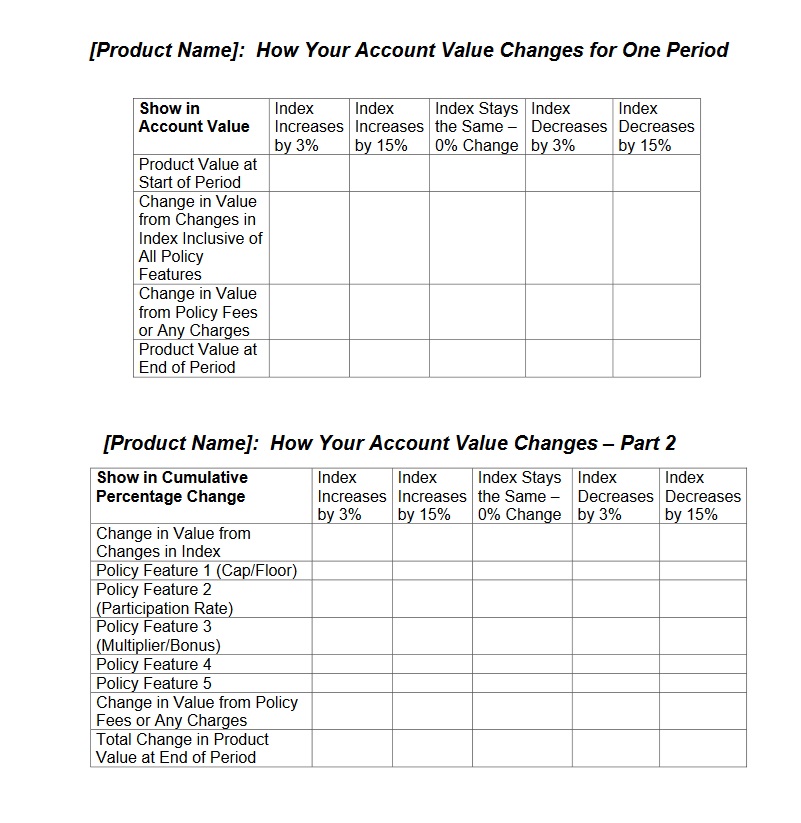

- A proposal: A table that would show how product features would perform in five standard scenarios.

Two longtime consumer advocates are renewing efforts to make hypothetical performance illustrations for life insurance and annuity products uglier.

For clients, illustrations serve as products’ easy-to-understand faces.

Birny Birnbaum and Brenda Cude are preparing to talk to state insurance regulators on Sunday about ways to put products in what they believe to be a more realistic, blemish-revealing light, at a session of the National Association of Insurance Commissioners’ Life Insurance and Annuities Committee.

Birnbaum and Cude will talk about the collision between clients’ lack of financial literacy and what they say is the overly pretty nature of many of the illustrations. The consumer reps are especially concerned about products with returns linked partly or wholly to the performance of investment indexes.

They want to block illustrations based on new investment indexes with unusually high 10-year returns, and they want to create a standardized chart or other tool that will show clients how index caps, index participation rates and provisions letting insurers change the caps and floors might affect product returns.

What it means: While the U.S. Department of Labor is working on an investment advice fiduciary definition and other regulations that could require agents to provide detailed compensation information when they help clients roll retirement plan assets into annuities or life insurance policies, state insurance regulators will be hearing concerns about product disclosures.

The NAIC: The federal McCarran-Ferguson Act of 1945 leaves insurance regulation to the states.

The NAIC is a Kansas City, Missouri-based group that helps the top insurance regulators in states and other jurisdictions, such as the District of Columbia and Puerto Rico, share information. The NAIC develops model laws, regulations, bulletins and other documents, and state legislators and regulators decide whether and how to use the models.

The NAIC has a program that gives insurance educators, advocacy group representatives and others a chance to serve as official representatives for consumers’ interests in NAIC deliberations.

Birnbaum, who is executive director of the Center for Economic Justice, and Cude, who is a professor emeritus at the University of Georgia, both serve as funded consumer liaison representatives. The NAIC helps funded reps participate in NAIC meetings by reimbursing each of them for up to $5,500 in travel expenses.

The history: Regulators and consumer reps have been working on efforts to improve illustrations for years. In 2015, the NAIC approved Actuarial Guideline 49, a set of model illustration requirements for indexed universal life products.

Since then, the NAIC has adopted an update, Actuarial Guideline 49-A, and an update to the update.

Actuarial Guideline 49 created a standard approach for calculating an indexed universal life product’s rate of return.

Actuarial Guideline 49-A limits the ability of an IUL policy issuer to use special policy features, such as bonuses, to increase the policy’s illustrated rate of return.

The update to Actuarial Guideline 49-A keeps an IUL policy issuer from using a volatility-controlled index and a fixed bonus to boost a policy’s illustrated rate of return.

November 30, 2023 at 03:46 PM

November 30, 2023 at 03:46 PM

Credit: Center for Economic Justice

Credit: Center for Economic Justice