One possible clue about how the U.S. annuity market could look in 20 years is that life insurers created the modern U.S. annuity market in the decade in the decade after the catastrophic 1918 influenza pandemic.

People with an interest in the topic can see how newspapers of the era covered the topic by searching through electronic newspaper archives, such as the Newpapers.com archive.

The consumers and life insurers in the U.S. insurance market in late 1918 had just gotten through World War I, faced the prospect of the country having to pay off mountains of war bonds, in were in the middle of the flu pandemic, which would kill about 600,000 Americans over three years, or 0.6% of the U.S. population, and would be especially hard on pregnant women and working-age men.

(Related: U.S. Life Insurers, Stocks Shook Off the 1918 Flu)

The 1918 death toll was to the 1918 U.S. population about what a death toll of 1.8 million would be to the current U.S. population.

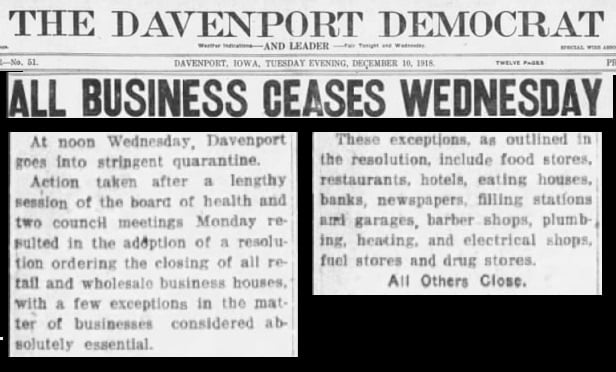

Each community set its own quarantine rules. The quarantines tended to be similar to, but shorter than, the lockdown rules being imposed today.

In Davenport, Iowa, for example, the health board imposed a quarantine on Dec. 10, 1918, that banned church services and public funerals, and shut down insurance brokerage offices, but exempted “absolutely essential” places, such as barber shops.

The health board was able to end that quarantine after just five days, partly because the incubation period for the 1918 flu was much shorter than the incubation period for COVID-19.

But one thing is clear: Once quarantines were over, newspapers of the era did not spend much time obsessing about post-quarantine trauma.

They did run some articles about the rise of the modern annuity market.

Here are five observations about the rise of the modern annuity market, drawn from newspaper articles of the era that are stored in the Newspapers.com database.

1. Life insurance benefits for returning World War I veterans helped plant the idea that having a personal old-age pension would be a great thing.

The veterans’ life insurance policies were supposed to provide a lifetime stream of income once a veteran was too old or too disabled to work.

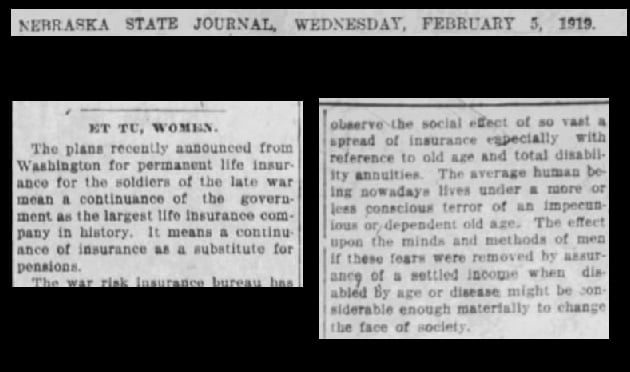

Newspaper editorial writers suggested that access to old-age income would be great for civilians, too.

On Feb. 5, 1919, for example, an editorial writer for the Nebraska State Journal wrote that the “social effect of so vast a spread of insurance, especially with reference to old age and disabilities” could ease the “more or less conscious terror” of old age, and that income protection insurance could “change the face of society.”

But newspaper reporter, columnists and advertisers faced a challenge that exists today: They generally felt the need to explain what an annuity was.

2. Newspaper columnists noted that annuities could be useful to women.

Even in the 1800s, life insurers promoted the idea that life insurance and annuities could help widowed women, and never-married women, live comfortably in old age.

Life insurers ran with that concept in the 1920s.

On Jan. 11 1926, for example, a reporter for the weekly Insurance News section in the Indianapolis Star suggested that a deferred annuity could help people provide for independence in the final years of life.

“To the professional man or woman, also to the business woman, this type of insurance makes a strong appeal when it is called to attention and understood,” the reporter wrote.

3. Life insurers thought the annuity market could be a good growth market.

On Dec. 28, 1928, W.B. Bailey, an economist for The Travelers, wrote that annuities, group insurance and business insurance were all products with bright prospects, and that annuities should do well partly because interest rates were falling.

“The long-term trend for interest rates is generally conceded to be downward,” Bailey wrote. “This is making it increasingly difficult for the elderly man or woman with limited capital to live on the income produced by that capital. Annuities, by guaranteeing a larger return than could be safely attained elsewhere, and by assuring an income which cannot be outlived, can do much to solve this problem.”

4. Annuities did well after the 1929 stock market crash, and after the month-long run on the banks that started in February 1933.

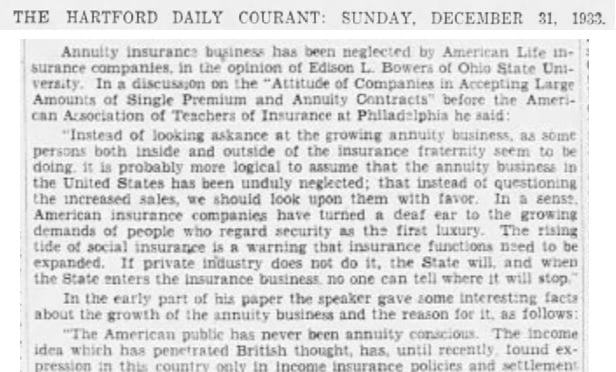

On Dec. 31, 1933, A.E. Magnell, an editor at the Hartford Courant, quoted Edison Bowers of Ohio State University as saying that the U.S. annuity market had grown dramatically since 1922.

Annuities had traditionally been much more popular in England than in the United States, but U.S. life insurers began selling them in earnest in the 1920s.

Annuities accounted for less than 1% of U.S. life insurers’ premium revenue in 1922, Bowers said.

Annuities’ share of life insurers’ premium revenue had increased to 5.7% by 1932, he reported.

The Great Depression might have increased the appeal of annuities, but annuity sales were already growing rapidly in the period from 1922 to 1927, before the depression started, Bowers said.

“Instead of looking askance at the growing annuity business, as some persons both inside and outside of the insurance fraternity seem to be doing, it is probably more logical to assume that the annuity business in the United States has been unduly neglected,” Bowers said. “That instead of questioning the increased sales, we should look upon them with favor.”

Insurers had ignored people’s growing demands for security, and “the rising tide of social insurance is a warning that insurance functions need to be expanded,” Bowers said. “If private industry does not do it, the State will, and when the State enters the insurance business, no one can tell where it will stop.”

5. Low interest rates could be a headache back then, too.

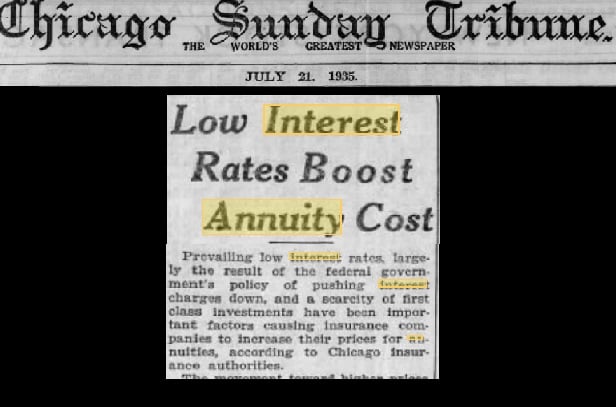

Some annuity article newspaper headlines from the 1930s look as if they could come from new articles.

On July 21, 1935, for example the Chicago Tribune ran an article with the headline, “Low Interest Rates Boost Annuity Cost.”

The reporter noted that the federal government’s efforts to push interest rates down had lowered life insurers’ bond investment earnings and forced big life insurers to increase annuity prices by 5% to 10%.

Rates on typical highly rated bonds had fallen to 3% or even lower, from a range of 3.5% to about 6%, the reporter noted.

In January 1938, A.M. Collens, the president of Phoenix Mutual Life Insurance Company, said in an annual statement letter printed in the Hartford Courant that low interest rates had forced the company to reserves for annuities and disability benefits. The company also revised contracts to make them more conservative.

— Read If HealthCare.gov Is Worth $17 Billion, What Does That Mean? Health Insurance 2020, on ThinkAdvisor.

— Connect with ThinkAdvisor Life/Health on Facebook, LinkedIn and Twitter.

April 21, 2020 at 05:28 PM

April 21, 2020 at 05:28 PM

Slideshow

Slideshow