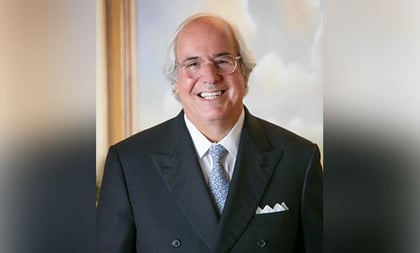

The fraudsters are “coming out of the woodwork.” Indeed, the coronavirus pandemic is “a win-win-win” for them, Frank Abagnale, the famous fraudster-turned-FBI consultant, tells ThinkAdvisor in an interview. His youth as a professional imposter and check forger inspired the film “Catch Me If You Can” starring Leonardo DiCaprio.

Abagnale, an authority on fraud, forgery and cybersecurity, 71, stresses that under stay-at-home orders, people — fearful and anxious amidst the outbreak and financial fallout — are more vulnerable to scammers.

In fact, he cautions that “during the next several weeks, more than ever in your life,” Americans must be super-careful to avoid being conned. That’s when the first economic impact payments under the Coronavirus Relief, Aid and Economic Security (CARES) Act are planned to be dispersed to taxpayers.

The danger, he warns, is that fraudsters will call, email or text insisting they need an individual’s address and personal information so they can send them a check.

Further: Beware of requests for donations that claim to help people with COVID-19 and for money for claimed treatments and cures. There are also scammers claiming to represent the Centers for Disease Control and Prevention and phony experts saying they have breakthrough information about the virus, Abagnale says.

During his 40-plus years as a consultant to the FBI, he never saw a scam whose only purpose was to cause physical harm — until now. Many COVID-19 scams are solely “malicious” and make no requests for money, says Abagnale, who details one in the interview.

Starting in 1969, the Westchester, New York, native served five years in prison for posing as an airline pilot, doctor, attorney, FBI agent and more, and for cashing $2.5 million in forged checks in 27 countries. He’d been sentenced to 12 years, but his imprisonment was reduced when he accepted an offer to be an unpaid consultant to the FBI.

Later, he founded Abagnale & Associates, based in Washington, D.C., which has advised about fraud prevention to more than 14,000 financial institutions, corporations and law enforcement agencies. Clients include the American Bankers Association, Experian, LexisNexis, Marriott, Trusona and Visa.

According to AARP’s April 2020 Bulletin, scamming has become “a big international industry,” and technology is “the fraudster’s friend.”

To be sure, in the interview, Abagnale, AARP’s fraud watch ambassador and co-host of its podcast, “The Perfect Scam,” discusses how today’s easy-to-use technology enables scammers.

ThinkAdvisor recently held a phone interview with Abagnale, who last year published “Scam Me If You Can: Simple Strategies to Outsmart Today’s Rip-off Artists” (Penguin Random House-AARP-2019).

In our conversation, he revealed the top two red flags for spotting scams, how financial advisors can help clients avoid being scammed, how easy it is to create fake checks and how, when conning his way around the globe, “the power of a Pan Am pilot’s uniform” helped him commit fraud.

Here are highlights from the interview:

THINKADVISOR: Has the incidence of scams increased during the coronavirus pandemic?

FRANK ABAGNALE: Scammers are coming out of the woodwork with all kinds of scams because amid our fears of coronavirus, the hard part of their work has been done for them: They always use headlines as opportunities to steal money or sensitive personal information. Hundreds of approaches are being used.

Are people more vulnerable to scammers at this time?

Yes. Now scammers have targets who normally wouldn’t be at home that are answering their phones. So for the scammer, it’s a win-win-win because they know that 99% of the time someone will be at the residence they call.

Any other reason that people are vulnerable targets right now?

They’re very scared, fearful. So when they hear some of these scams, unless they know better, they may end up falling for them. A lot of smart people just hang up. But scammers know that if they make 1,000 calls, a percentage of people will fall for the scam. Their pitch is very professional sounding; they [falsely] back up things with elaborate websites — but they just make all that [stuff] up.

Is there anything unique about the scams that the pandemic has generated?

What’s different and really concerning about COVID-19 scams is that a lot of them are malicious — no money is being made from them. The regular scams I’ve seen during my whole career have always been based on: How much money can I make from scamming this person?

What’s an example of a malicious coronavirus scam?

On March 30, a letter supposedly sent from the city of Charleston, S.C., on government letterhead, went to students at the College of Charleston telling them to come to an address downtown and line up: They could be tested for a coronavirus vaccine, and they’d be given $5,000 for agreeing to take the test.

What was behind the scam?

Just getting these kids to stand in line next to each other — and they did. It’s very disconcerting to see that people would do something so malicious during a crisis like this.

What’s your advice to avoid scams right now?

During the next several weeks [when the CARES Act payments to Americans are planned to be sent out], more than ever in your life, you have to be very careful of phone calls or emails telling you to click on a site or of people trying to get information from you. They might say there’s a vaccine for COVID-19 or a place for testing.

You recently wrote in GovCon Wire that CARES money meant for citizens “… will … end up in misdirected payments to fraudsters” because to receive those payments, the IRS has proposed that many fill out online forms asking for sensitive financial information. Another reason is that the federal and state governments’ use of “antiquated” technology results in incomplete data “… sounds like fraudsters’ Christmas and birthdays have come all at once,” you say. Please elaborate.

April 13, 2020 at 12:23 PM

April 13, 2020 at 12:23 PM