$1.7 million. That’s how much Americans believe they should save in order to retire, according to a Schwab survey of 1,000 401(k) plan participants between the ages of 25 and 70. Unfortunately, few are likely to attain that goal.

Almost 60% of survey respondents said their 401(k) plan was their only or largest source of retirement savings, and 51% are contributing less than 10% of their salary to their 401(k), with the average annual contribution totaling $8,788.”

“The people we surveyed have a realistic target for retirement, but many likely aren’t on track to get where they want to go,” said Steve Anderson, president of Schwab Retirement Plan Services in a statement. Only 23% of respondents reported contributing the maximum allowed in their 401(k) plans, which is currently $19,000 annually for employees under 50 and $25,000 for those 50 and older.

Yet close to 90% of survey respondents consider a 401(k) account a “must-have benefit,” almost as important as health insurance coverage.

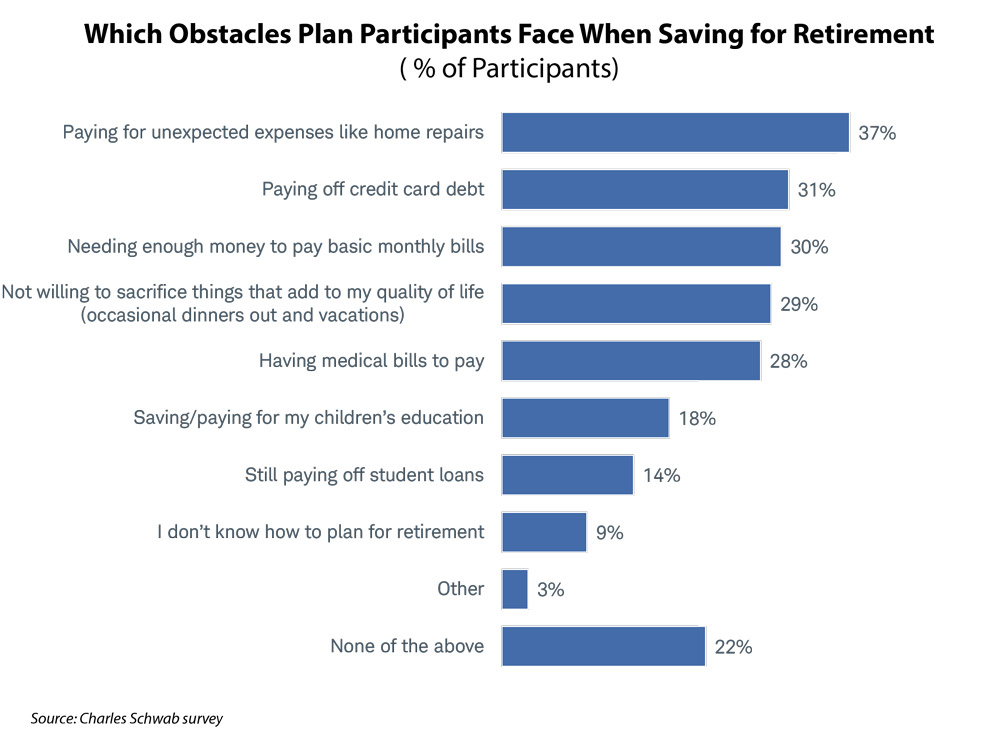

There are multiple reasons that employees aren’t saving enough for retirement, according to the Schwab survey.

Many start too late in life, which makes it almost impossible to reach $1.7 million in assets. Schwab found that if employees start saving at age 45, they need to invest as much as 35% of their salary to reach that goal, but if they start saving in their 20s, a 10% to 15% salary contribution should suffice.

The respondents’ initial contribution rates did not reflect their retirement goals but rather the percentages respondents are comfortable with, qualify for their company’s contribution match, or are set by their employers for auto-enrollment.

June 11, 2019 at 03:27 PM

June 11, 2019 at 03:27 PM