Your indexes are about to be rejiggered. You may want to alert your financial advisor.

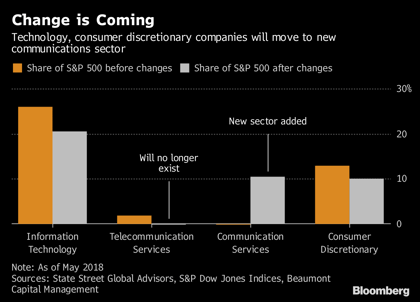

S&P Global Ratings and MSCI Inc. announced their decision to shake up the Global Industry Classification Standard (GICS) structure last year, combining phone companies with internet and media stocks into a sector called “communication services.” The changes are set to hit in September.

But as the clock ticks closer, countless advisors apparently are still unaware of the nearing transformation.

Dave Haviland, managing partner of Beaumont Capital Management, a Needham, Massachusetts-based wealth manager, just finished a tour around the country, hitting Georgia, Alabama, Utah, Arizona, Louisiana and California to speak to advisors and clients both in person and at conferences. At the end of each conversation, he made a point to ask if anyone was aware of the sector reconstitution. And the disconcerting answer was an overwhelming, “No.”

“You would be absolutely blown away by how many people have never heard of it even today,” Haviland said by phone. “I asked after each one, ‘Has everyone heard of this?’ And it was just like deer in headlights.”

July 13, 2018 at 12:57 PM

July 13, 2018 at 12:57 PM