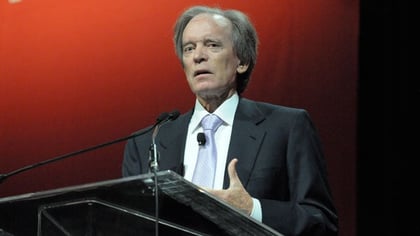

Bill Gross had his worst day in four years yesterday. For other bond managers, it was more like Christmas in May.

The steep decline in interest rates triggered by fears that Italy might leave the euro sent Gross’s $2.1 billion Janus Henderson Global Unconstrained Bond Fund down about 3 percent Tuesday, making a bad year even worse. Other prominent funds recorded their biggest one-day gain since 2009.

Bond yields plummeted Tuesday on prospects that Italy might need a fresh election that could be a referendum on the nation’s inclusion in the euro zone.

The yield on the 10-year Treasury note dropped to 2.78 percent from 2.93 percent. Rates rebounded Wednesday as investors deemed the market reaction to Italy’s political turmoil overwrought.

The $77.2 billion Metropolitan West Total Return Bond Fund, the $38.1 billion Bond Fund of America and the $23.5 billion Western Asset Core Plus Bond Fund all climbed about 1 percent, the largest one-day gain in roughly nine years. Falling rates translate to an increase in bond prices.

May 30, 2018 at 01:13 PM

May 30, 2018 at 01:13 PM