In the world of insurance, agents are much more likely to retain clients for the long term if those clients hold numerous products through one particular agent relationship. When establishing and maintaining relationships with clients, it is essential to have the ability to meet the broad-spectrum needs of clients. After all, clients have a penchant for one-stop shopping.

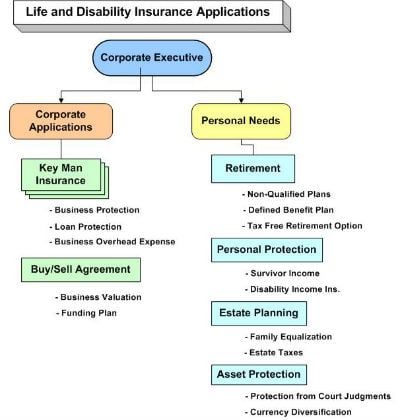

In working with corporate executives, it’s beneficial to provide solutions to both their business and personal coverage requirements — as, oftentimes, these two are highly correlated. P&C agencies are a great source of clients — many of whom have complex asset protection and wealth preservation needs.

It’s been our experience that a private business life cycle, in combination with its owner’s management role cycle, represents an opportunity for P&C agencies to offer multiple applications of life products including life insurance, disability insurance and annuities.

It’s been our experience that a private business life cycle, in combination with its owner’s management role cycle, represents an opportunity for P&C agencies to offer multiple applications of life products including life insurance, disability insurance and annuities.

However, although P&C and life insurance are both coverage solutions, they are typically viewed by clients as completely different products and services, with life insurance viewed as a personal product and P&C coverage viewed as more of a corporate product.

Consequently, the agents that sell these two distinct product lines apply different approaches with their respective clients. The difference in products and associated services are, in fact, vast. Accordingly, the respective agents think, act and work differently, with neither truly understanding the other’s innate product lexicon.

There are three distinct types of P&C agencies. First, there are very large national and multinational agencies, such as Marsh, Aon, Gallagher, and Willis, with offices in every major city in the United States. The second group consists of top 100 agencies that include regional P&C agencies that may employ 75 or more people. The third is the small mom-and-pop agency that employs 20 or fewer agents.

The middle group — the regional P&C agencies — are the ones that typically face the biggest risk of losing their most profitable clients to the national full-service P&C agencies, who dominate the market. Some regional P&C agencies are facing increasing competitive pressures from national agencies that have captive insurance subsidiaries offering specialized P&C insurance coverage at lower premiums. This gives the powerhouses a decided cost advantage over local and regional agencies.

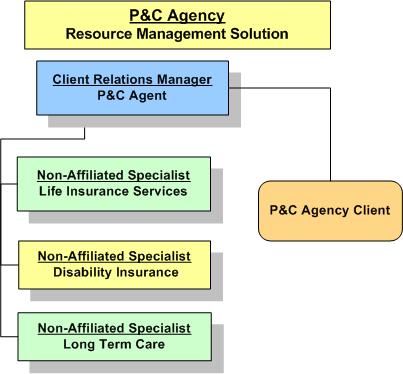

In response, some P&C agency managers want their agency to be viewed as having the capabilities to meet all of their clients’ insurance needs: P&C, life, disability income, longterm care and group medical. Some agencies have created inhouse life and benefits groups in an attempt to make their operation a seamless and complete resource for their P&C clients.

Invariably, agencies have tried and failed in previous attempts to cross-sell life insurance products. In many cases, the initiative was doomed from the start since it usually came down to pressuring existing P&C agents to sell life products. Or it was a case of cronyism, engaging a longtime friend and life agent to assist them in building their life practice. As is often the case, the newly hired life agent was met with distrust by P&C agents.

P&C agency owners know successful P&C agents have different skill sets and personality characteristics than advanced market life agents who are successful in selling life insurance. Ask any agency owner, and he or she would tell you that industry professionals have selective skills that are suitable for either the sale of P&C products or life and financial products, but not both, while group insurance personnel are not suited to engage a CEO or CFO in a conversation on estate or succession planning.

June 20, 2013 at 11:37 AM

June 20, 2013 at 11:37 AM

Unfortunately, those life subsidiaries offer limited underwriting solutions, which typically are not competitive with the underwriting of major life insurance carriers — nor do they offer the variety of life products or services that are offered by the

Unfortunately, those life subsidiaries offer limited underwriting solutions, which typically are not competitive with the underwriting of major life insurance carriers — nor do they offer the variety of life products or services that are offered by the