Increasing contribution limits on health savings accounts, which is included in a recent bill that has passed the House, may not have the intended desired effect. That’s because few HSA account owners contribute the current maximum.

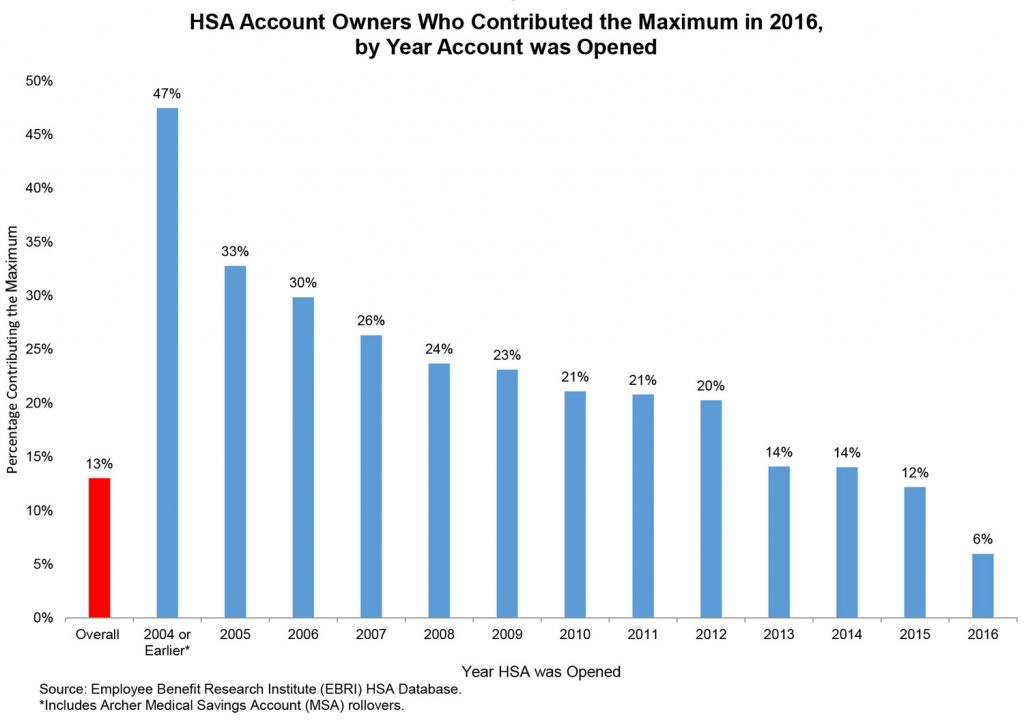

According to the Employee Benefit Research Institute, just 13% of HSA account holders contributed the maximum in 2016, which is the latest available data. The maximum contribution then was $3,350 for individuals and $6,750 for families plus $1,000 additional for single and family coverage when the primary account holder was 55 or older. The comparable current maximums are $3,450 and $6,900 plus an extra $1,000 for account holders 55 and older.

(Related: House Passes HSA Bills to Expand Access, Boost Contribution Limits)

EBRI finds that the longer an account holder has an HSA, the more likely they will contribute the maximum amount. While only 6% of account owners who owned accounts in 2016 contributed the maximum amount that year, 47% of account holders who had owned their account since 2004 or earlier did.

Maximizing contributions also reflects the investment attitudes of account holders and the availability of investments. EBRI found that 44% of account holders who invest their HSA balances contribute the maximum allowed as opposed to 12% of account holders who don’t invest.

Not all HSAs, however, allow for investments other than cash equivalents. In 2016, only 3% of the accounts in EBRI’s database offered other investment choices.

Not all HSAs, however, allow for investments other than cash equivalents. In 2016, only 3% of the accounts in EBRI’s database offered other investment choices.

July 31, 2018 at 08:49 PM

July 31, 2018 at 08:49 PM