What You Need to Know

- At a hearing on various retirement proposals, the executive, Eric Stevenson, asked lawmakers to give auto-enrollment provisions from the Secure acts time to work.

- Consumers wildly overestimate how much income $100,000 can generate, Dan Doonan of NIRS said.

- The American Retirement Association blasted the idea offering a government retirement plan access bill.

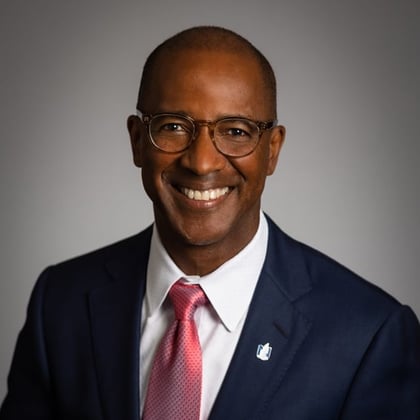

A Nationwide retirement executive told members of a U.S. Senate committee Wednesday that the U.S. Department of Labor’s fiduciary definition proposal would hurt workers’ retirement security.

“It will stop a lot of the things that we’re working on that are so positive,” Eric Stevenson, president of Nationwide Retirement Solutions, said. ”It’s a major distraction.”

He asked Congress to give the new automatic retirement plan enrollment provisions and automatic contribution escalation features included in the Secure Act and the Secure 2.0 Act time to work.

“And let’s do everything that we can to remove the barriers that keep a business owner from launching a 401(k) plan and making that available to all of their employees,” Stevenson said.

Stevenson was testifying at a retirement security hearing organized by the U.S. Senate Health, Education, Labor and Pensions Committee. He talked about the new DOL fiduciary rule efforts in response to a question from Sen. Ted Budd, R-N.C.

What it means: The DOL fiduciary definition proposals are getting some attention in the Senate.

The hearing: Sen. Bernie Sanders, the Senate HELP chair and a Vermont independent, organized the hearing partly to promote efforts to make high-income people pay more payroll taxes and partly to promote S. 3102, the Retirement Savings for Americans Act of 2023, a bill that would let any worker without access to an employer-sponsored retirement plan participate in a plan organized by the federal government, with a matching contribution from the federal government.

Sen. Bill Cassidy, R-La., the highest-ranking Republican on the committee, noted that the majority organized the hearing without input from the Republicans on the committee.

“There are things we can do on a bipartisan basis,” Cassidy said.

He noted that he himself has introduced bipartisan retirement bills.

Sen. Maggie Hassan, D-N.H., is working with Budd on legislation that would make it easier for very small employers to use existing federal retirement plan creation tax incentives.

The retirement planning backdrop: “One out of every four senior citizens in America are trying to live on an income of less than $15,000 a year,” Sanders said. “Half of our nation’s seniors are trying to survive on an income of less than $30,000 a year.

“How do you pay the rent, how do you pay for health care and prescription drugs, and how do you put food on the table on just $15,000 or even $30,000 a year?” Sanders asked.

Dan Doonan, executive director of the National Institute on Retirement Security, said the current system puts too much of a burden on individual retirement savers.

February 29, 2024 at 04:14 PM

February 29, 2024 at 04:14 PM