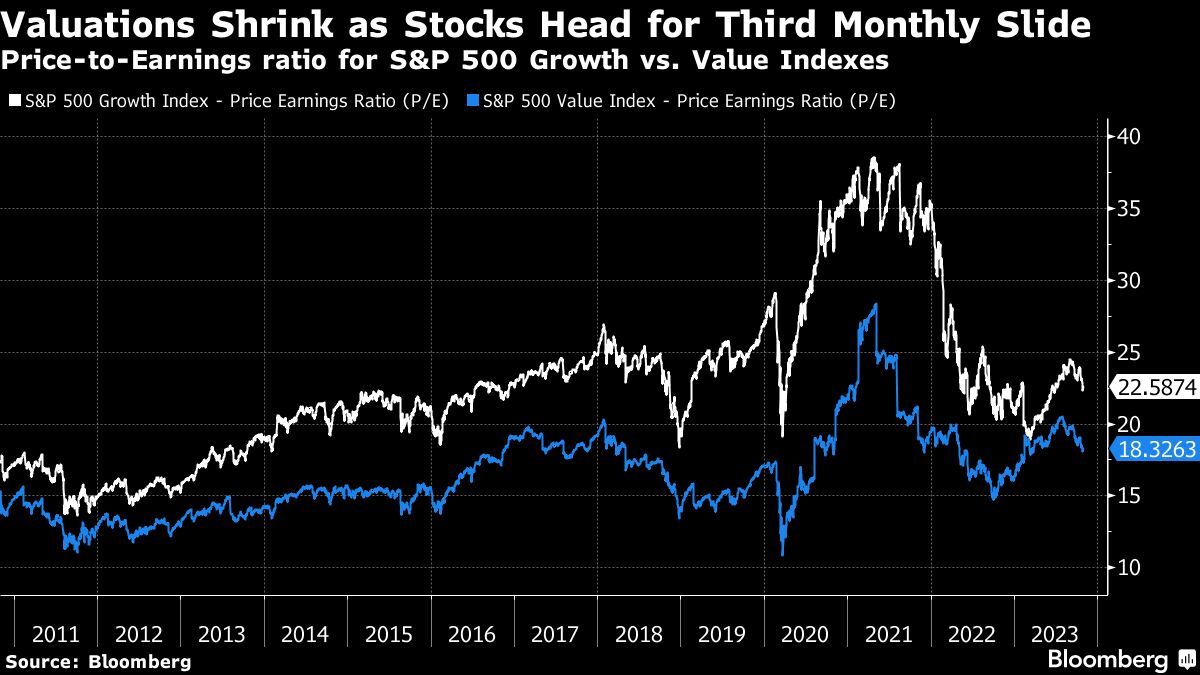

The latest leg down in U.S. stocks coupled with a solid earnings season so far has dropped S&P 500 company valuations closer to historical averages.

The combination provides an opening for investors to consider value stocks, according to JPMorgan Asset Management’s David Kelly.

The chief global market strategist is still wary of big tech stocks though, as the group’s price-to-earnings ratio remains elevated relative to history.

The S&P 500 has tumbled 10% from its July peak, and companies in the index are on track to report 2.1% profit growth for the third quarter. That’s brought the P/E ratio of the index toward 20, compared with a long-term average of more than 16.

Remove the 10 biggest companies from the calculus — mostly big tech — and the P/E sits at 15.6. The 10 heavyweights have a combined value of 26-times projected earnings, some 131% above their long-term average.

Source: JPMorganWhere to Focus

Source: JPMorganWhere to Focus

Where to Focus

While Kelly recommends considering value stocks — a cohort that looks relatively cheap compared with fundamentals — he’s not saying it’s a slam dunk decision, given the headwinds from higher interest rates and geopolitical turmoil.

“The opportunity in the U.S. equities is looking better than for quite some time,” Kelly said in a phone interview. “You just have to have the guts to get in.”

October 31, 2023 at 02:44 PM

October 31, 2023 at 02:44 PM