What You Need to Know

- It's time to move beyond using a one-year cap strategy tied to the S&P 500 to calculate the interest on a fixed indexed annuity.

- The current interest rate environment should have advisors considering volatility-controlled indexes instead.

- Since these indexes are designed to manage volatility within the index, hedging is much less costly.

When I began to urge advisors to consider incorporating fixed indexed annuities into their practice back in 2006, I highlighted the importance of keeping the story simple. Specifically, I stressed the need to be able to answer the question: “How did the insurance company calculate the interest they credited to my policy?”

To answer this question, I offered a simple solution: stick with one-year cap strategies based on the S&P 500 (SPX). Why needlessly complicate things?

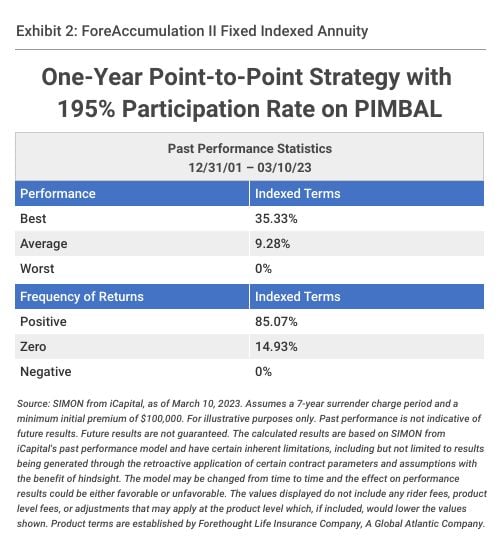

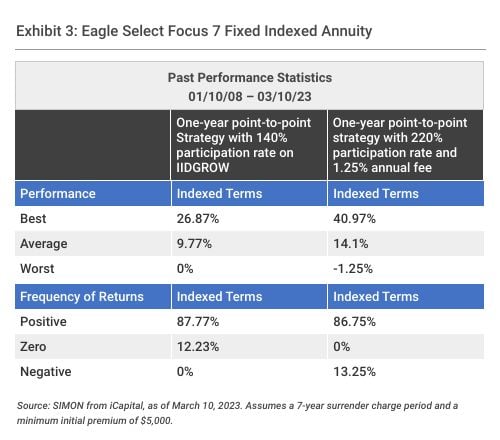

Increasingly, advisors are exploring other options within the indexed annuity space. According to Wink’s Sales and Market Report, in the third quarter of 2022, only 44% of fixed indexed annuity sales were in a cap rate strategy tied to the S&P 500 Index. In other words, more than half of all sales were tied to indexes other than the S&P 500.

In addition, LIMRA noted in its 2021 Fixed Indexed Annuity Sales and Assets report that only 16% of total sales were allocated solely to a cap rate strategy, while participation rate strategies captured 39%. Another 22% of total sales were allocated to a combination of participation and cap rate strategies.

Obviously, there are a lot of advisors today who are not following my 2006 guidance. Is it time for me to follow their lead? Let’s take a look at a sample of fixed indexed annuities on the market and see.

1-Year Cap Strategies in Action

Since its inception in 1957, the S&P 500 has an average annual return of 10.67%. If an indexed annuity policyholder had an 11% cap rate on the S&P 500 for every possible one-year period, the average return over time would have been 6.64%.

In a world where protection is a primary cap goal for many investors, it’s easy to understand the attraction of an expected 6.64% return with full protection of principal. No one should be surprised, therefore, that LIMRA reported that indexed annuity sales hit record levels in the third quarter of last year, and then broke that record in the fourth quarter.

Using SIMON from iCapital’s Annuities Platform, we can view the hypothetical performance metrics across one-year indexed terms between April 18, 1957, and March 10, 2023. The best return in any of those one-year indexed terms would have been 11%, or the cap. Since a fixed indexed annuity without a fee cannot have a negative return, the worst return would have been 0%. The average return across all of the observed one-year indexed terms would have been 6.64%.

It is also worth noting that 72.31% of the observed one-year indexed terms would have resulted in a positive return, while 27.69% would have resulted in a 0% return.

Embracing Volatility

Despite these expected results, I have to admit that it’s time for me to join those advisors who have already moved beyond the simple one-year point-to-point strategies on the S&P 500. My message today is if you have not considered some volatility-controlled indexes, the time to do so is now.

The rapid increase in interest rates over the course of 2022 has led to a corresponding increase in the general accounts of insurance companies, enabling them to allocate more funds to the “options budget” of the indexed annuity and offer more attractive rates across the board.

April 10, 2023 at 02:04 PM

April 10, 2023 at 02:04 PM