What You Need to Know

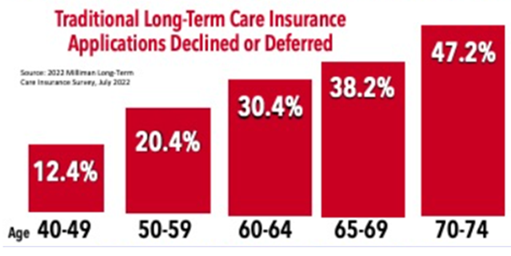

- Some clients may never qualify to buy medically underwritten long-term care products.

- The odds get worse as they age.

- Another problem: Clients who buy later pay higher premiums.

The answer: Buy it as young as possible — preferably in your mid-40s to early 50s.

The question: When is the best time for your clients to buy long-term care insurance?

Why? The younger your clients are when purchasing this protection, the less they will pay over the life of the policy.

Here are four reasons why:

- The premium is based on your health. Usually, the younger the clients are, the healthier . . . and the lower the premium.

- Pricing is calculated based on the client’s current age. The younger the client is, the lower the premium. for both the traditional and hybrid products.

- A hybrid policy’s limited-pay structure can save a client thousands of dollars. Paying the entire policy premium, for example with either a single-pay or 10-pay option, usually results in paying considerably less money overall. Otherwise, with the traditional policy, the client continues paying until the client needs care.

- The power of compounding means that the longer the client has the policy, the more the benefit will grow every year as a result of the 3% or 5% inflation benefit.

The Details

1. Health

Most traditional carriers offer three or four rate classes, ranging from Preferred to Class 1 and Class 2. Better health means a better rating and a lower premium.

Your client should buy this coverage now, if possible, no matter what the client’s age, if there is a family history of Alzheimer’s, vascular dementia, Parkinson’s or multiple sclerosis.

These diseases can be genetic.

The carriers are very concerned about family history. Two carriers are now refusing to even consider any applicant when both parents had dementia.

Being eligible for a couple’s discount by having both spouses apply will lower the premium. However, that discount will be less if a spouse is ineligible because of poor health.

Your client’s health determines if the client will be able to even buy this coverage.

When I start working with a client, I ask detailed questions about the client’s health. If I think there is a potential problem, I then submit the client’s information to the carriers as a preunderwriting inquiry. I maintain the client’s confidentiality: The client is identified by a number, not a name.

Only when I have received a green light from the carrier will I move forward with submitting an application.

We are seeing an increase in the number of applicants being denied coverage. Here is the most recent data on the Long Term Care Insurance Applicant Denials.

Denial data from the 2022 Milliman Long Term Care Insurance Survey. (Image: American Association for Long-Term Care Insurance)

Denial data from the 2022 Milliman Long Term Care Insurance Survey. (Image: American Association for Long-Term Care Insurance)

2: Age-Based Premiums

Here’s a look at how age affects a client’s premiums.

Joe and Mary are married, and both are age 49.

They are considering buying a traditional policy for $5,000 a month, for four years for her and three years for him, both with a 3% inflation benefit and first-day home health care.

February 28, 2023 at 06:41 PM

February 28, 2023 at 06:41 PM