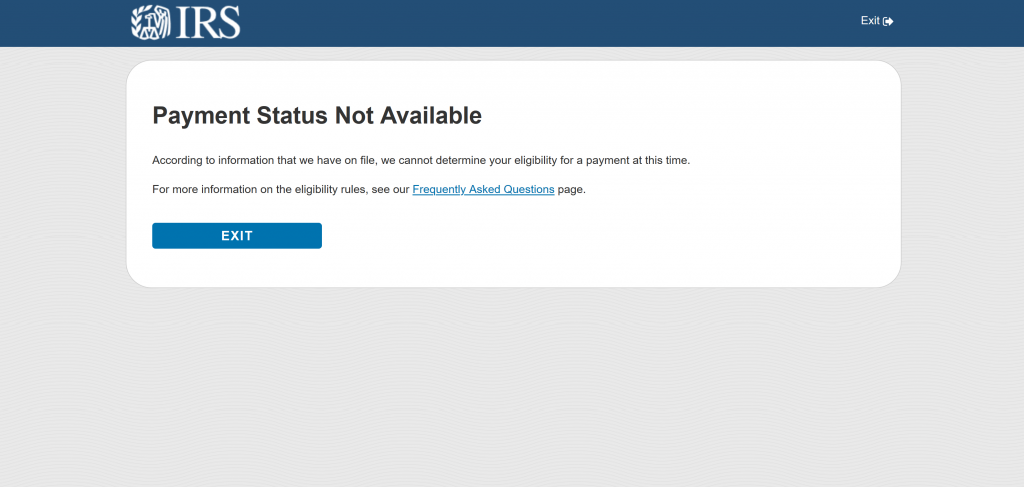

Taxpayers who filled out the form were met with this message on Wednesday.

Taxpayers who filled out the form were met with this message on Wednesday.

The online tool launched Wednesday by the Internal Revenue Service and Treasury Department was designed to provide a way for Americans to easily check on the status of their Economic Impact Payments, but Twitter was quickly filled with complaints that it wasn’t providing any information at all.

The “Get My Payment” tool launched Wednesday on IRS.gov. Users enter their Social Security Number, date of birth, street address and ZIP code. The tool is then supposed to provide the status of each user’s payment, including the date their payment is scheduled to be deposited into their bank account or mailed to them.

However, many users of the tool complained on Twitter that the only message they received after entering the requested information was “Payment Status Not Available” in large black type, followed in smaller type by “According to information that we have on file, we cannot determine your eligibility for a payment at this time. For more information on the eligibility rules, see our Frequently Asked Questions page.”

“Payment Status Not Available” is just so wild. The IRS will find you if you live in Mordor, but if you try to get your #Stimuluscheck they’ve suddenly never heard of you.

— Claire James Carroll (@ClaireJCarroll) April 15, 2020

ThinkAdvisor received the same message multiple times Wednesday. However, when we tried again later in the afternoon, we received a slightly different message, saying: “Please Try Again Later. We are unable to provide you with the status of your payment or perform the action requested because:

- The tax return information you entered does not match our records; or

- You have already accessed the system the maximum number of times today.

Please come back after 24 hours and try again.”

The IRS and Treasury Department didn’t immediately respond to requests for comment.

In announcing the tool’s launch, the Treasury Department said it also allows taxpayers who filed their tax returns in 2018 or 2019 but did not provide their banking information on either return to submit direct deposit information. Once users do that, “they will get their Economic Impact Payments deposited directly in their bank accounts, instead of waiting for a check to arrive in the mail,” it said, noting the tool was launched on what would have been Tax Day if not for the coronavirus pandemic.

April 15, 2020 at 03:26 PM

April 15, 2020 at 03:26 PM