When investing client assets in ESG-focused funds, don’t just consider a fund’s investment strategy and holdings; look also at its proxy voting history and current votes on shareholder resolutions, now that the proxy voting season is underway. What you find may surprise you and/or your clients.

According to a new report from Morningstar focused on climate-related shareholder resolutions in 2018, only funds from traditional socially responsible fund companies like Calvert (owned by Eaton Vance) and Pax World Funds voted consistently in favor of climate-related proxies that garnered the support of more than 40% of shareholders.

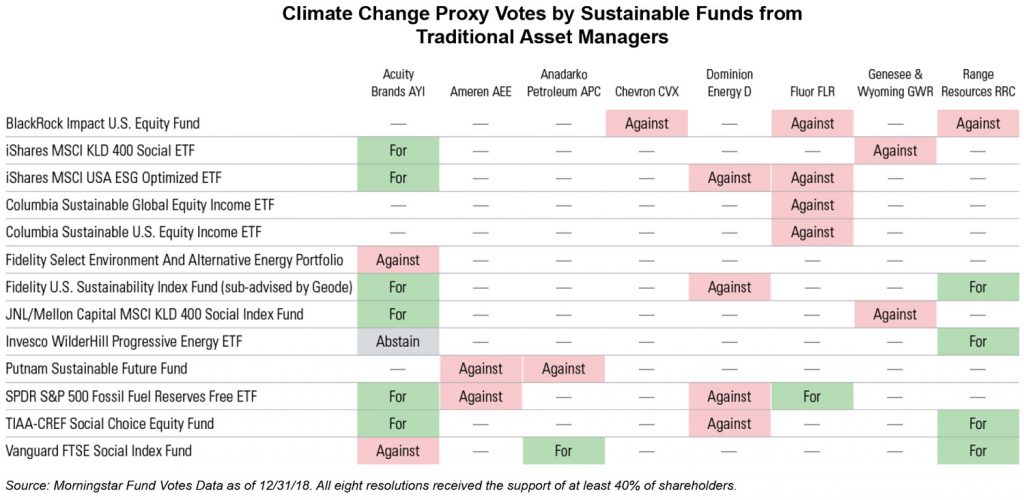

ESG funds from more traditional fund companies like BlackRock and Fidelity often voted against those resolutions. BlackRock opposed more climate change resolutions than other traditional asset managers, according to Morningstar, despite statements by CEO Larry Fink about the importance of environmental, social, and governance issues for corporate valuations, included in his annual letter to CEOs.

“Much of the focus when evaluating funds with an ESG mandate is on the screens and research used to decide which companies to include in a portfolio,” writes Jackie Cook, Morningstar’s director of sustainable stewardship research. “But proxy voting and engaging with corporate management are two other ways in which funds can have a more direct impact on corporate policies that align with their ESG mandates.”

Note that fund companies must disclose their proxy vote, not their engagement with companies on ESG or other issues.

According to the Morningstar report, Fidelity index funds, managed by Geode Capital Management, and State Street funds, including its index SPDR funds, voted in favor of climate change shareholder resolutions close to half the time in 2018 — a far higher percentage than BlackRock and Vanguard – and more frequently than in previous years.

But State Street, Fidelity, Vanguard and BlackRock all voted similarly on 2018 shareholder resolutions concerning executive pay, favoring 15% or fewer of them, according to a report on the most overpaid CEOs published by As You Sow, a nonprofit organization focused on shareholder advocacy.

CEO pay will be one of many subjects included in this year’s proxy voting season, but climate change and corporate political activity, which together accounted for just under 40% of resolutions last year, will account for almost 50% this year, according to As You Sow’s Proxy Preview, a total of the 386 shareholders resolutions filed as of mid-February with another 303 still pending.

March 19, 2019 at 04:28 PM

March 19, 2019 at 04:28 PM