The U.S. economy is showing some vulnerabilities as investors take increasing risks with corporate debt and businesses rely on “historically high” borrowing levels, the Federal Reserve said Wednesday in its first-ever financial stability report.

“High leverage has historically been linked to elevated financial distress and retrenchment by businesses in economic downturns,” the U.S. central bank said in the report. “Such an increase in financial distress, should it transpire, could trigger a broad adjustment in prices of business debt.”

(Related: Money Managers Cool on Some Leveraged Loan Deals)

The Fed also cautioned that escalating trade tensions could trigger a “particularly large” drop in asset prices because “valuations appear elevated relative to historical standards.” Equity prices, in particular, are “somewhat high” relative to corporate earnings forecasts.

But the news was far from all bad. The report, which the Fed intends to issue regularly, noted that Wall Street banks are “strongly capitalized,” broker-dealers’ leverage is much lower than it was before the 2008 financial crisis and insurance companies are healthy.

The document’s release comes on the heels of a shake-out in financial markets. The Standard & Poor’s 500 Index has slipped recently on a variety of concerns, from worries about the U.S.-China trade war to doubts about lofty valuations of technology shares. Corporate bond spreads have also widened as investors have become more risk averse in the face of higher interest rates from the Fed.

Still, the economy is primed to rack up its fastest growth since 2005 this year and is on course to achieve its longest-running expansion ever in the middle of 2019. Unemployment is at a 48-year low, and inflation is right at the Fed’s 2% target.

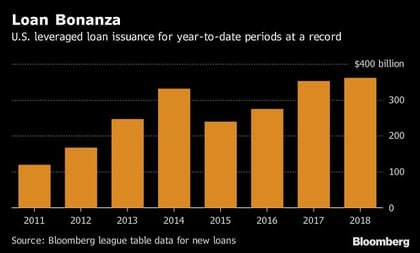

Having noted that investors are “appearing to exhibit a high tolerance for risk-taking,” the report highlights particular concern with leveraged lending, finding that the riskiest companies are the ones piling on the most additional debt.

Analysts at Moody’s Investors Service recently said they believe the life insurers they rate have increased their exposure to leveraged loans only modestly, due mainly to the fact that leveraged loans now make up a large part of the overall fixed-income investment market.

November 28, 2018 at 06:06 PM

November 28, 2018 at 06:06 PM