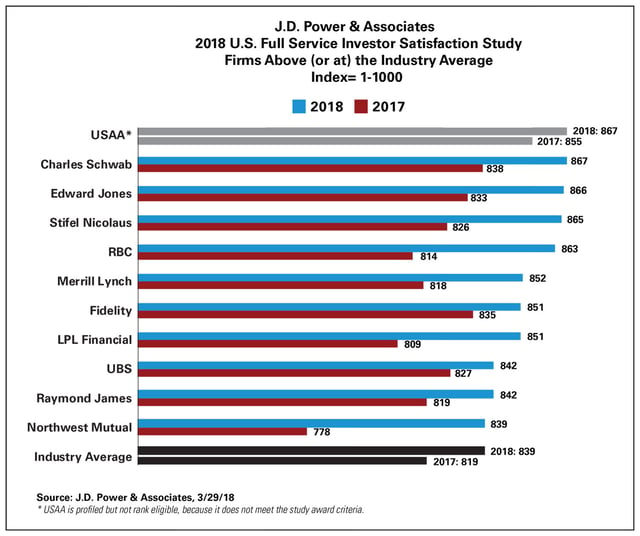

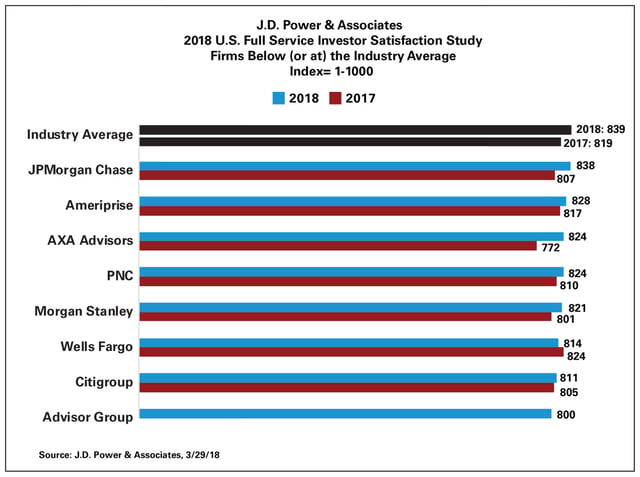

Investors are happier with their full-service broker-dealers than they were a year ago, the latest J.D. Power survey finds.

The overall industry average score rose by 20 points to 839 (out of 1,000). Plus, satisfaction increased for 18 of the 19 firms cited by investors in the 16th annual U.S. Full Service Investor Satisfaction Study.

(Related: Best & Worst BDs for Advisors: J.D. Power — 2017)

But the survey also reveals that millennials — the generation set to inherit a sizable chunk of the estimated $30 trillion great wealth transfer — are the least loyal group of full-service investors.

What are those born between 1982 and 1994 most interested in?

“The vast majority of boomers and Gen Xers … are very unlikely to switch [firms] unless the advisor they have a relationship with moves [from one firm to another],” said Mike Foy, senior director of J.D. Power’s Wealth Management Practice, in an interview.

“Millennials, even those who are relatively satisfied with the firms they do business with, have not made a commitment to the firm and are considering other options,” Foy explained. “They are much more likely to have a self-directed, robo and/or other accounts, meaning they are much more ‘up for grabs’ in terms of their loyalty.”

In addition, while great digital experiences help firms attracting Millennial clients, technology alone will not keep them fully engaged, according to J.D. Power.

“It’s a bit counterintuitive,” Foy explained. “When you look at loyalty and clients’ intention to stay with their current provider, their digital experience is not predictive of that.”

What is predictive of client though is the traditional value of human advice and how satisfied investors are with their advisor communications.

“It’s about feeling that their advisors help them to [clarify] their [financial] goals … and show progress in meeting these goals,” he said.

Still, it’s important that full-service firms give investor clients a valuable digital and mobile experience, according to Foy, “to complement traditional client-advisor relationship rather than compete with it.”

For instance, among millennial investors who communicate with their advisors via social media, texting and/or video communications, overall satisfaction is 58 points higher than for investors in this age group not working with advisors who use these digital channels.

J.D. Power’s research is based on responses collected in December 2017 from nearly 4,200 investors who have a relationship with an advisor.

— Check out Best Firms for Self-Directed Investors: J.D. Power — 2017 on ThinkAdvisor.

March 29, 2018 at 03:28 PM

March 29, 2018 at 03:28 PM

Slideshow

Slideshow