Some 65-year-olds who buy Medicare supplement (Medigap) “Plan G” coverage could end up paying about three times as much as their neighbors pay.

Those 65-year-olds could pay about five times as much for Plan G Medigap coverage as 65-year-olds in other cities.

The American Association for Medicare Supplement Insurance (AAMSI) has published data on Plan G price variations in a new commentary.

Resources

- The new AAMSI Medigap price analysis is available here.

- A link to an article about the Medigap letter plan shift is available here.

The Westlake Village, California-based group produced the price analysis to promote a Medigap agent directory.

Medigap Basics

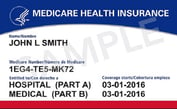

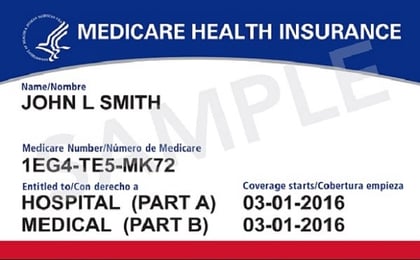

The Medicare Part A program covers hospital bills for people ages 65 and older, many people with Social Security Disability Insurance, and people with severe kidney disease. The Medicare Part B program covers physician and outpatient services bills. Together, the programs leave many holes in coverage. One reason for the “patient cost-sharing arrangements” is to discourage patients from seeking unnecessary or overly expensive care.

Each Medigap plan is supposed to offer a standardized package of benefits. Each package is designated by a letter, such as A, C or F. In the past, the most popular type of Medigap coverage has been Medigap Plan F — a rich policy that fills in just about all Original Medicare gaps.

Some policymakers have argued that Plan F encourages Medicare enrollees to get too much care. Because of that concern, Congress is now requiring insurers to phase out Plan F coverage. Instead, issuers are supposed to sell Medigap Plan G coverage. A Plan G policy covers all Original Medicare holes other than the Medicare Part B deductible.

People who were eligible to buy Medigap coverage before Jan. 1 can still buy Plan F coverage.

For other consumers, Medigap Plan G policies are now the richest Medigap policies available.

The Analysis

For the new price gap analysis, AAMSI looked at Plan G prices in specific ZIP codes in 10 large U.S. markets.

February 10, 2020 at 10:58 AM

February 10, 2020 at 10:58 AM