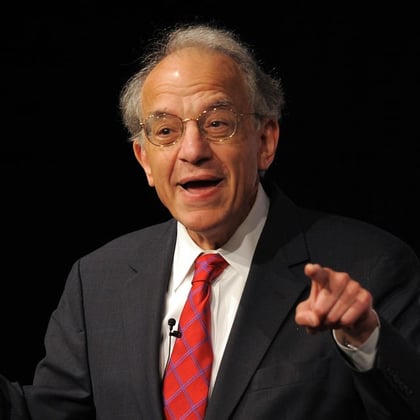

While economic strength is fueling good stock market performance, Wharton economist Jeremy Siegel continues to believe that “the risks are to the downside,” he said in commentary posted Tuesday.

“The stock market is performing well despite interest rates trending higher because of continued economic strength. Waiting for the recession has been like waiting for Godot —promised to happen but never arriving. So, earnings chug on and downgrades in earnings are yet to come,” the finance professor emeritus said in a post on WisdomTree.com, where Siegel is a senior investment strategy advisor.

The Federal Reserve “should definitely stop raising rates and not raise again,” he wrote, noting that mortgage rates are above 7% again. “Another raise in rates will prompt people to ask, ‘Why am I staying in 1% savings accounts or 0% checking accounts? I should find these higher-yielding money markets or short duration Treasury funds yielding over 5%.’”

Important data releases this week, including home price and labor market information, may determine the Fed’s action when its interest rate-setting committee meets in June, Siegel wrote. “The labor market is the prime gauge I believe will dictate the Fed’s decision come Friday,” he said.

The government on Wednesday released the latest Job Opening and Labor Turnover Survey results, which showed higher-than-expected job openings, indicating the labor market remains resilient, Yahoo Finance noted.

The Bureau of Labor Statistics is scheduled to release new jobs data on Friday.

“If the jobs market is not super-hot, then I believe the Fed will not increase rates in June. But if unemployment drops even further and the jobs gain is over 200,000, there will be continued pressure from the hawks to keep raising rates,” Siegel said.

“The economy ostensibly is humming along without any meaningful slowdown, but we should not assume the opposite — that everything is booming either.”

May 31, 2023 at 05:01 PM

May 31, 2023 at 05:01 PM