What You Need to Know

- The amount of individual life insurance in force increased in 2020, in spite of the revenue drop.

- The amount of group life and credit life coverage in force also increased.

- The number of stock companies in the life and health markets fell 3%.

The American Council of Life Insurers’ new Life Insurers Fact Book 2021 tells the story of just how hard the COVID-19 pandemic hit life, health and annuity issuers in 2020.

Life premiums fell 5.5% from the 2019 total, to $148 billion, and health insurance premiums decreased 0.9%, to $186 billion.

Meanwhile, as the 70 million baby boomers continued to age, payments into the individual and group annuities they will need to support them in retirement plunged 13%, to $301 billion.

That compares with a 3.5% drop in U.S. gross domestic product between 2019 and 2020, and 7.3% in the portion of GDP related to services.

Fewer Carriers

The big, publicly traded U.S. life and health insurers mostly reported higher revenue and solid profits for 2020.

The ACLI bases the data in its annual fact books on figures from the National Association of Insurance Commissioners, which has information from insurers of all sizes.

The new fact book suggests that life insurers organized as stock companies may be feeling especially intense pressure.

The total number of life insurers fell to 747, from 761.

Here’s what happened to the insurer count by charter type:

- Fraternal: 74 (unchanged)

- Policyholder-owned mutual: 110 (up from 108)

- Miscellaneous: 10 (up from 8)

- Stock: 553 (down from 570)

The surviving insurers made $45 billion in sales commission payments to agents, down 3.6% from the 2019 total.

Benefits

Despite the pressure on life insurers, they managed to increase the total number of life insurance coverage in force by 3%, to more than $20 trillion.

Death benefits and other payments from life insurance policies increased 6.5%, to $128 billion.

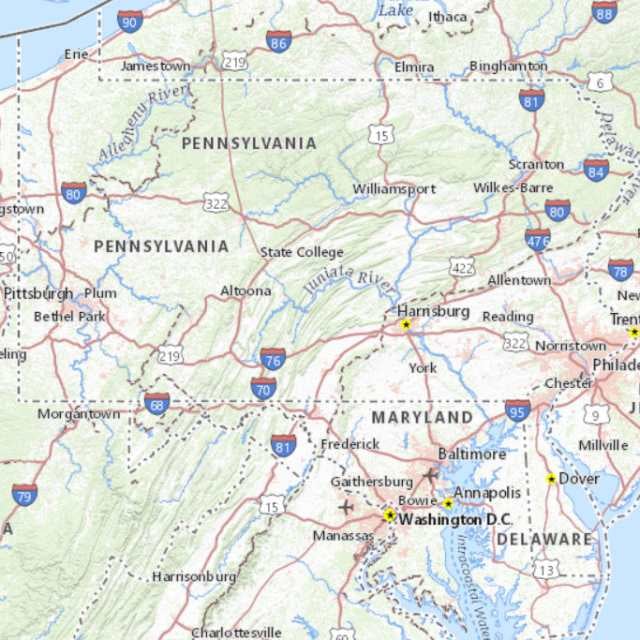

Total annuity contract payments fell 2.4% to $392 billion. (For a look at the five states with the biggest annuity benefit payment amounts, see the gallery above.)

(Image: Adobe Stock)

December 15, 2021 at 02:57 PM

December 15, 2021 at 02:57 PM

Slideshow

Slideshow