For all the attention lavished on gold for its relative durability during this global dash into risk, the real story could be the companies digging it out of the ground.

A growing chorus of big names — including everyone from the quants at Bernstein to Pictet’s multi-asset team — is turning increasingly bullish on miners as late-cycle angst and industry shifts make conditions ripe for a prolonged rally.

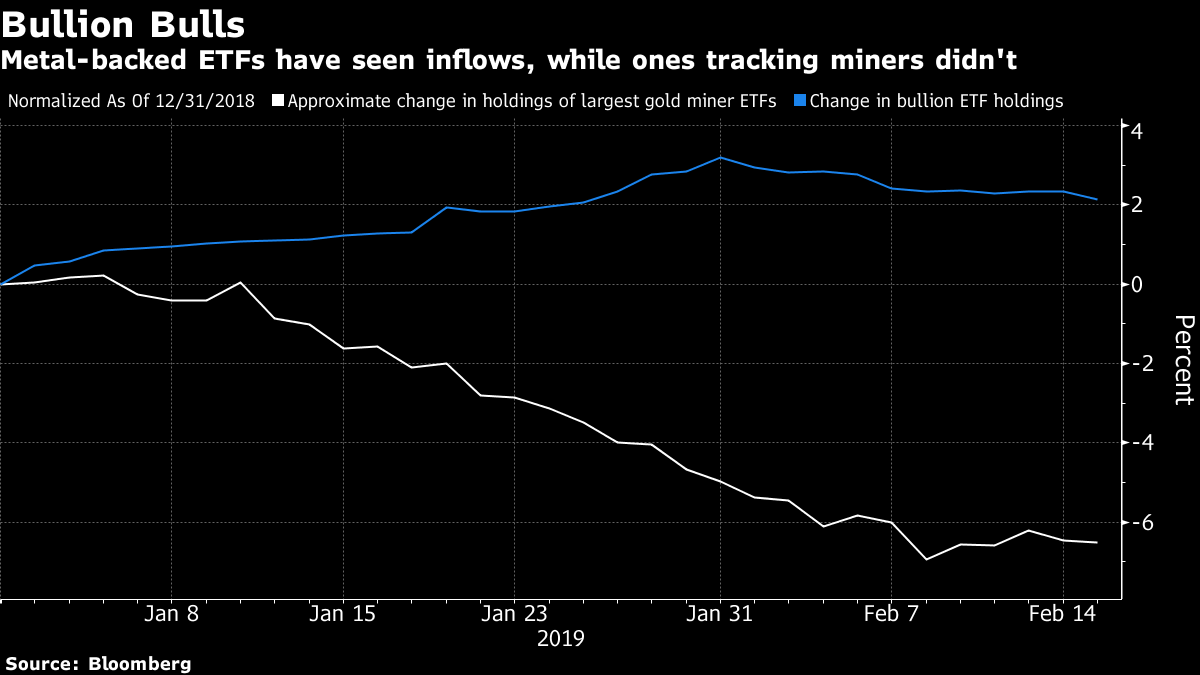

Mining shares have gained at more than twice the pace of bullion this year, even as the metal hit a 10-month high on Tuesday, and the evidence suggests they can outperform the physical metal in an economic slowdown.

Over the last 10 years, they traded with a correlation of 0.8 and a beta of 1.8 compared to gold. That means the two moved in lockstep, but when gold rallied investors who bet on miners were rewarded with a return about 80 percent larger.

At Bernstein, quantitative strategists led by Inigo Fraser Jenkins are seeing a laundry list of reasons to like gold and gold miners just now. They’re adding both, but see a tactical case for shares of metal producers in particular.

“One of the key strategic themes that underlies our outlook is that we think there is a low return outlook across asset classes,” the strategists wrote last week. “The practical issue of holding gold is the lack of yield, or an ability to value it in a conventional way. So for portfolio managers of equity and multi asset portfolios an attractive alternative might be to hold the equity of gold miners.”

The growing interest in gold and associated assets comes at a critical time for global markets. Equities and debt have been surging in 2019 as investors chase late-cycle gains, but the rally has been laced with doubt as economic data increasingly points to a global slowdown.

Heavy-weight commodity analysts like those at Societe Generale have recommended buying both gold and miners this year, saying the metal should “break free” in 2019 amid a scarcity of safe havens.

For Pictet Asset Management, there are additional reasons to look at miners. Merger and acquisition activity suggests the industry itself is bullish. Barrick’s $5.4 billion purchase of Randgold Resources Ltd. set off a chain reaction that led to Newmont Mining Corp.’s $10 billion deal for Canada’s Goldcorp Inc. last month.

“When miners start acquiring each other, this suggests the market is underpricing the value of their assets, namely the gold they’ve yet to mine,” Shaniel Ramjee a senior investment manager in the Pictet multi asset team, wrote in a note.

February 19, 2019 at 04:13 PM

February 19, 2019 at 04:13 PM