The main trust fund behind Medicare, the U.S. health care program for the elderly and disabled, will be exhausted in 2026, three years earlier than was projected a year ago, the government said Tuesday.

Medicare’s Board of Trustees blamed the earlier depletion forecast on expectations of lower payroll taxes and less revenue from taxing Social Security benefits, both the result of the new Tax Cuts and Jobs Act, tax overhaul signed by President Donald Trump last year, according to a senior administration official. Medicare is also expected to spend more than projected last year, the report said.

“As in past years, the Trustees have determined that the fund is not adequately financed over the next 10 years,” the report said.

(Related: Meet Your Multiemployer Pension Nightmare: Actuary to Lawmakers)

Each year, the trustees project the long-term finances of Medicare, which covers about 58 million Americans. Medicare spent $710 billion in 2017, according to the report, making it the single biggest purchaser of health services in the U.S. The trustees include Treasury Secretary Steven Mnuchin and Health and Human Services Secretary Alex Azar.

The long-term solvency is also affected by lawmakers’ repeal in February of a controversial Obamacare effort to cut spending known as the Independent Payment Advisory Board, according to the official.

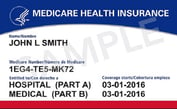

Medicare’s trust fund pays for hospital visits, nursing care and related services under what’s known as Part A of the program, which was created in 1965. Medicare Part B, which covers outpatient visits, and Part D, which pays for most prescription drugs, are paid for in part by general revenue and by individuals’ premiums. That means those programs don’t face a risk of funds running out.

June 06, 2018 at 07:02 PM

June 06, 2018 at 07:02 PM