Financial Industry Regulatory Authority (FINRA) has stepped up investigations and disciplinary actions against broker-dealers (BDs) and individual registered representatives, according to a new study from Washington DC-based law firm Sutherland Asbill & Brennan LLP.

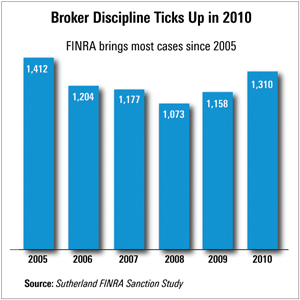

Deborah Heilizer and Brian Rubin, Sutherland partners, and an associate, Andrew McCormick, found that the number of actions brought by FINRA jumped in 2010 to 1,310, the highest number since 1,412 were brought in 2005, according to the “Sutherland FINRA Sanction Study.”

Overall, however, they found that the dollar amount of fines was significantly less in 2010, at $45 million, than 2005's $184 million in fines and even the $50 million in fines in 2009. Fines are off, said Rubin (left), in an email message to AdvisorOne, because “several years ago, there were large cases (such as the market timing cases) that resulted in very large fines,”

Overall, however, they found that the dollar amount of fines was significantly less in 2010, at $45 million, than 2005's $184 million in fines and even the $50 million in fines in 2009. Fines are off, said Rubin (left), in an email message to AdvisorOne, because “several years ago, there were large cases (such as the market timing cases) that resulted in very large fines,”

Reputation Risk

Firms that don’t heed FINRA’s more aggressive stance on enforcement and prevent the types of behaviors that bring on these investigations risk sullying their reputation and lowering their net profits because of the negative publicity and financial hit these actions can cause.

“We are seeing more aggressive enforcement from FINRA," Rubin said in the release accompanying the report. "Substantively," he said, "FINRA is focusing on an increasingly broad range of issues.” His practice includes representing firms and individuals under investigation or prosecution by FINRA, states, or the Securities and Exchange Commission (SEC). “Procedurally, this aggressiveness has been illustrated by the types of information requested and the deadlines being imposed."

“We are seeing more aggressive enforcement from FINRA," Rubin said in the release accompanying the report. "Substantively," he said, "FINRA is focusing on an increasingly broad range of issues.” His practice includes representing firms and individuals under investigation or prosecution by FINRA, states, or the Securities and Exchange Commission (SEC). “Procedurally, this aggressiveness has been illustrated by the types of information requested and the deadlines being imposed."

“FINRA may have brought more cases because of pressure on them, following Madoff, Stanford and the market crash," Rubin said in the email message. “It's hard to say why the fines are down, other than that there have been fewer ‘supersized’ fines.”

These cases are unrelated to investor arbitration suits and awards. “These are disciplinary proceedings where FINRA finds wrongdoing (as opposed to investors/customers who are making claims in [arbitration]),” Rubin noted.

The Top Five Types of FINRA Actions, according to the Sutherland study:

- Advertising–At $4.75 million, advertising cost BDs the most in fines of any type of violation.

- Credit Default Swap (CDS)–Six CDS cases brought in $4.5 million in fines, and were mostly about “alleged improper communications about customers’ proposed brokerage rate reductions in the wholesale CDS market.” The study noted, “It is unclear whether this high 2010 ranking for CDS cases signals a change in FINRA’s enforcement program or whether these cases represent the completion of FINRA’s work in this area.”

- Electronic Communication—Resulted in about $4 million in fines to FINRA, in 34 cases. “This includes more than $2.1 million in fines for failing to adequately maintain and preserve company e-mails in 23 cases.”

- Suitability—FINRA levied a total of $3.75 million in fines for 53 suitability cases in 2010. These included “sale of collateralized mortgage obligations (five cases, $760,000 in total fines), closed-end funds (three cases, $1 million in total fines), and reverse convertible notes (two cases, $710,000 in total fines).”

- Short Selling—On the top enforcement list for the first time in 2010, short –selling cases resulted in fines of about $3.5 million, in around 50 actions. Most, (34) were for “accurate reporting of short sales,” however, the study noted, “nearly $1 million in fines from 14 actions were imposed for allegedly accepting a short sale without borrowing the security or entering into an agreement to borrow the security.”

Enforcement Trends Revealed

February 28, 2011 at 09:16 AM

February 28, 2011 at 09:16 AM