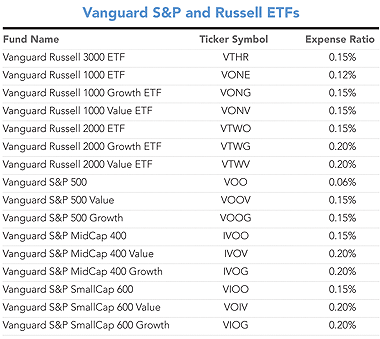

It was a busy third quarter for the Vanguard Group. The Valley Forge, Pa.-based fund giant expanded its ETF menu by adding 16 equity ETFs linked to S&P and Russell indexes.

The new Vanguard ETFs follow large, mid and small company U.S. stocks with growth, value and blend characteristics.

The Vanguard S&P 500 ETF (VOO), which also debuted, now serves as the ETF share class for the company’s flagship Vanguard 500 Index Fund (VFINX). At the end of August the latter had over $86 billion in assets.

The Vanguard S&P 500 ETF (VOO), which also debuted, now serves as the ETF share class for the company’s flagship Vanguard 500 Index Fund (VFINX). At the end of August the latter had over $86 billion in assets.

“The new Vanguard index funds and ETFs offer our trademark low costs and tax efficiency, and aim for the utmost tracking precision. They will appeal to financial advisors and institutional investors seeking to build portfolios based on S&P benchmarks. The new ETFs will help Vanguard continue to build momentum in the ETF marketplace,” said Vanguard chairman and CEO Bill McNabb.

The Vanguard Russell ETFs, according to Morningstar data, will have an average expense ratio of 0.16 percent which is lower than the 0.23 percent average expense ratio of competing ETFs.

November 01, 2010 at 06:51 AM

November 01, 2010 at 06:51 AM