This year’s second-quarter results exclude those of First Republic Bank, which was seized by regulators and acquired by JPMorgan on May 1. For the deal, JPMorgan made a $10.6 billion payment to the Federal Deposit Insurance Corporation.

“We reported another quarter of strong results …,” said JPMorgan CEO Jamie Dimon in the firm’s latest earnings release. “Even after the First Republic transaction, we maintained an extraordinarily strong [Common Equity Tier] 1 capital ratio of 13.8% and had $1.4 trillion in cash and marketable securities.”

Dimon views the U.S. economy as “resilient.” But, he explained: “Consumers are slowly using up their cash buffers, core inflation has been stubbornly high (increasing the risk that interest rates go higher, and stay higher for longer), quantitative tightening of this scale has never occurred, fiscal deficits are large, and the war in Ukraine continues … .”

Also this quarter, UBS Group moved its Q2’2023 earnings announcement back to Aug. 31 from earlier in the summer, due its $3.2 billion acquisition of Credit Suisse in March.

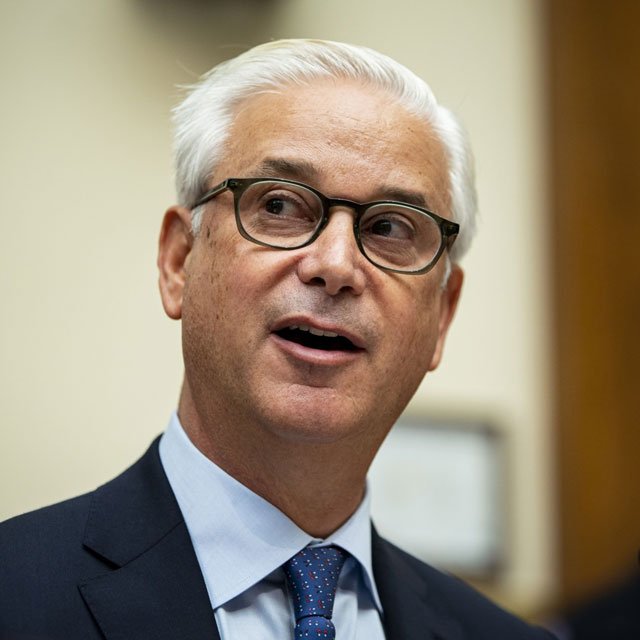

Speaking about the Credit Suisse integration, UBS CEO Sergio Ermotti told Bloomberg on Thursday: “There is no room for nostalgic considerations. We are executing on the strategy, we are making very good progress.”

UBS said this week that it planned to cut some 3,000 jobs in Switzerland in the short term as part of its $10 billion cost-savings plan. The Credit Suisse deal has expanded UBS’s workforce to about 120,000, which the bank would like to reduce by about 30% over time. UBS also aims to get rid of the Credit Suisse brand by 2025, according to a Bloomberg report.

Overall, the majority of broker-dealers, seven, reported improved year-over-year earnings in Q2’2023. Four BDs, however, saw their earnings slide from the same quarter of 2022.

Financial firms will kick off the third-quarter earnings season on Oct. 13, when Citigroup, JPMorgan and Wells Fargo plan to report their latest results.

(Image: Chris Nicholls/ALM)

August 31, 2023 at 01:13 PM

August 31, 2023 at 01:13 PM

Slideshow

Slideshow