Mobile apps and websites have become a critical component of the overall wealth management client experience, as investors increasingly consult digital first to review their investments, make transactions and conduct research, according to a study released Tuesday by J.D. Power.

The research found that the trend is pronounced among younger investors, who report significantly higher overall satisfaction and stronger brand advocacy when they engage frequently with their firm’s wealth management app.

“Wealth management firms that want to attract and retain younger investors need to focus on continuing to improve their apps,” Mike Foy, senior director of wealth intelligence at J.D. Power.

“The mobile app really is becoming the center of the modern wealth management client user experience, and that’s true not just for do-it-yourself investors but also for those who work with a financial advisor,” Foy explained.

J.D. Power fielded the survey from June through August, and received responses from 6,375 full-service and self-directed investors.

Mobile App Preferences

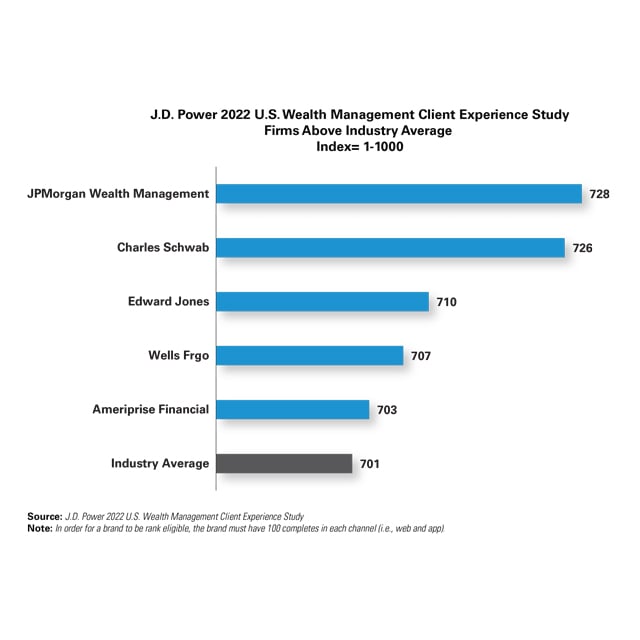

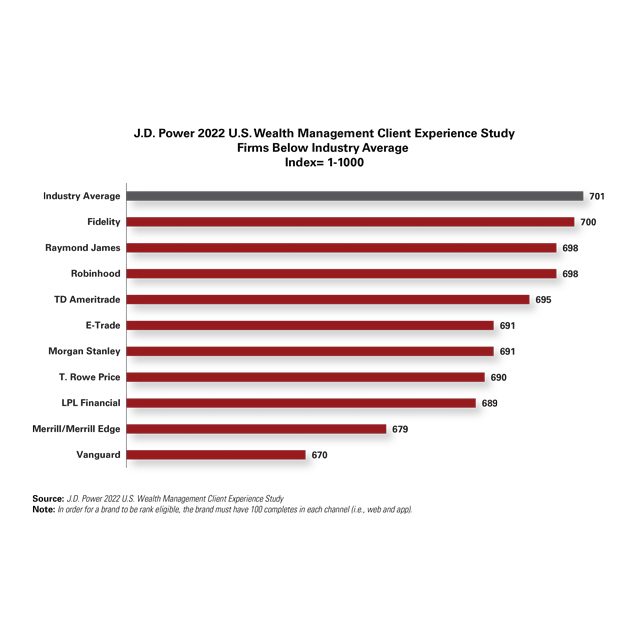

According to the survey findings, U.S. wealth management apps outperform websites, scoring 731 (on a 1,000-point scale), 50 points higher than the average score for wealth management websites. J.D. Power said this gap is driven mainly by younger investors’ strong preference for apps.

Client satisfaction with mobile apps is highest among older millennials, an average score of 760, followed by Generation Z with an average score of 720, the survey found.

Older investors, who are more likely to use their wealth management firm’s website, express lower satisfaction with mobile apps.

J.D. Power found that top-performing mobile apps that earn the highest levels of overall customer satisfaction also have strong brand advocacy, as measured by average Net Promoter Scores of 83 (on a scale of -100 to 100). That compares with an NPS of 73 among top-performing websites.

The study also gave the lie to the perception that mobile wealth management apps and websites are designed primarily for do-it-yourself investors, those who have no advisor interaction with the primary investment firm.

In fact, overall client satisfaction scores were higher among advised investors, who are more likely to use the digital financial tools provided by their wealth management firms, including tools that help connect them to their financial advisor more efficiently and conveniently.

“Firms that are delivering the best overall digital experience are recognizing that their apps and websites are an extension of the client relationship and can be leveraged to improve relationships with advisors, drive brand loyalty and differentiate from the competition,” Amit Aggarwal, senior director of digital solutions at J.D. Power said in the statement.

See the gallery for the firms that rank highest and lowest in overall client satisfaction with the wealth management digital experience.

November 22, 2022 at 10:07 AM

November 22, 2022 at 10:07 AM