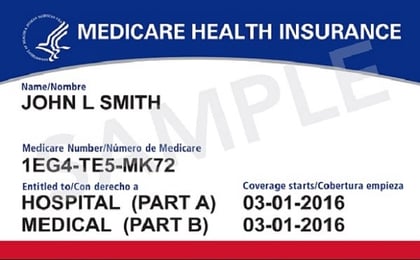

The simple test for being “newly eligible” is the date of an individual’s 65th birthday, or for someone younger, the date of their eligibility for Medicare due to disability or disease.

The date of enrollment for benefits does not matter for the purposes of MACRA. If a person’s birthday anniversary was on Jan. 1, 2020, for instance, that person would be a newly eligible person, and the rule applies. It doesn’t matter that their Medicare entitlement would have begun in the previous month; it’s their 65th birthday that determines their MACRA status.

Not Newly Eligible: Anyone who was eligible for Medicare prior to Jan. 1, 2020, because they were 65 or older, or who was otherwise eligible for Medicare before that date, is not newly eligible, regardless of whether they ever enrolled for benefits. For instance:

- Someone whose 65th birthday was prior to Jan. 1, 2020, but delayed enrollment in Medicare is not newly eligible.

- Someone who was awarded Social Security Disability Insurance retroactively, with their eligibility for Medicare occurring prior to Jan. 1, 2020, is not newly eligible.

- Someone who is eligible for Medigap guaranteed issue under federal or state law and was age 65 or eligible for Medicare due to disease or disability prior to Jan. 1, 2020, is not newly eligible.

MACRA Effect on Medigaps

A newly eligible individual can’t buy Medigap plans C, F, or high-deductible (HD) F because these plans include a benefit for the Medicare Part B deductible. Instead, anyone newly eligible for Medicare can buy Medigap plans D, G, and high-deductible (HD) G.

These Medigap plans do not contain the prohibited benefit for the Medicare Part B deductible.

This does not mean that Medigap plans C, F, and high-deductible F will become unavailable, nor does it mean that premiums will immediately skyrocket. Federal law requires companies selling Medigap in a state to make Medigap plans C or F available, and that requirement was not changed by MACRA.

Some people will still be able to buy Medigap plans C, F, or HD F under certain conditions, under the laws of their state, if they were eligible for Medicare prior to Jan. 1, 2020.

— Connect with ThinkAdvisor Life/Health on Facebook, LinkedIn and Twitter.

![]() Bonnie Burns is a training and policy specialist consultant at California Health Advocates.

Bonnie Burns is a training and policy specialist consultant at California Health Advocates.

November 24, 2019 at 06:57 PM

November 24, 2019 at 06:57 PM