The odds that the new Republican tax package can push retirement plan provisions through Congress this year appeared to weaken Wednesday.

Budget analysts at the Joint Committee on Taxation and the Congressional Budget Office predicted in a new report that retirement plan provisions in the package would add about $23 billion to the federal budget deficit in 2019, and about $53 billion over a 10-year period.

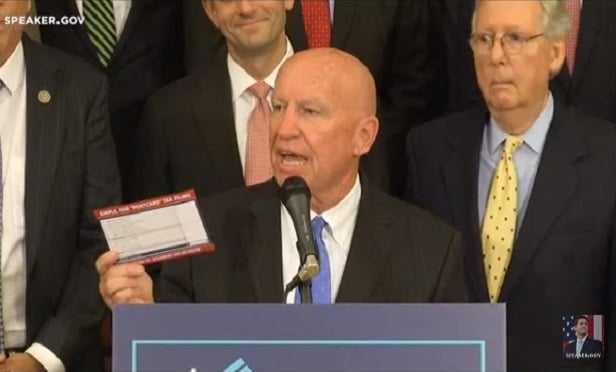

House Ways and Means Committee Chairman Kevin Brady and other package supporters also ran into strong opposition to the bill from Democrats on the House Rules Committee.

The House Rules Committee gets legislation ready for consideration on the House floor.

Some Democrats have supported some of the provisions in the Republican tax and retirement plan package in the past. But Democrats complained Wednesday, during a House Rules Committee meeting, that Republicans had shut them out of efforts to draft the new package, or even to look at the package.

“The first time we saw this was Tuesday night,” Rep. Jim McGovern, D-Mass., the highest-ranking Democrat on the committee, said at the hearing.

For life and annuity professionals, one key provision in the package would encourage employers to offer annuitization features within 401(k) plans, by shielding employers that choose lifetime income option providers against some provider-related lawsuits.

(Related: What the Return of the 401(k) Annuitization Fight Means for You)

Another key provision would help employers join together to offer multi-employer retirement plans.

The high budget impact figure and the cool reception from Democrats may weaken the odds that the package will be able to reach President Donald Trump’s desk during the current session of Congress, either on its own or as part of a bigger anti-government-shutdown spending authorization package.

Part of the federal government is now on track to shut down, due to lack of a congressional spending measure, Dec. 7.

Republicans now have a solid majority in the House but only a narrow majority in the Senate.

Republicans need 60 votes in the Senate to get ordinary bills through the Senate, and 51 votes to get some budget-related measures through the Senate. If all Democrats stick together, they would have to win over just two Republicans in the Senate to block an anti-shutdown spending measure containing the Brady package.

The Package

Brady, a Republican from Texas, has structured the retirement plan provisions package as an amendment to a separate package of proposals related to tax rules and Internal Revenue Service operations.

The tax package itself is, officially, a proposal to amend H.R. 88, the “Shiloh National Military Park Boundary Adjustment and Parker’s Crossroads Battlefield Designation Act” bill.

The House Rules Committee approved a version of the retirement plan provisions text given here, along with amendments, including 403(b) plan amendments, summarized here.

Here are examples of some of the retirement plan provisions in the package, in addition to the retirement plan annuitization safe harbor provision and the multi-employer plan provision:

Section 304 (Repeal of Maximum Age for Traditional Individual Retirement Account Contributions): This provision would let older people who are still working continue to contribute to IRAs.

Section 312 (Relief from Required Minimum Distribution Rules for Individuals With Low Account Balances): This section would free IRA holders with account balances of $50,000 or less from having to take cash out of their IRAs.

Section 331 (Penalty-Free Withdrawals): This provision would let IRA and 401(k) plan users take up to $7,500 from an IRA or retirement plan within one year after the birth or adoption of a child without facing any tax penalties.

House Rules Committee

House Rules Chairman Pete Sessions, a Republican from Texas, lost his seat in the Nov. 6 general elections.

Jim McGovern, the Massachusetts Democrat, appears to be in line to take over as the chairman of the House Rules Committee in January.

Rep. Jared Polis, a Democrat from Colorado, has sparred with Sessions in the past. He was absent from the meeting Wednesday.

Polis won the election to become the next governor of Colorado starting in January. His team’s last day in its Washington offices was Wednesday, according to Polis’s Twitter feed.

It’s not clear whether Polis knew much ahead of time that the committee was going to be meeting Wednesday.

Rep. Norma Torres, D-Calif., said during the meeting that she had been told earlier in the week that the committee would not be meeting this week.

Resources

The Congressional Budget Office has posted an analysis of the effects of the tax package, including the retirement plan provisions, here.

The House Rules Committee has posted a number of resources related to the package, including a video of the meeting, here.

— Read H.R. 1628 Chaos Raises Odds for ACA Survival, on ThinkAdvisor.

— Connect with ThinkAdvisor Life/Health on LinkedIn and Twitter.

November 29, 2018 at 01:58 PM

November 29, 2018 at 01:58 PM

Slideshow

Slideshow