Editor’s Note: This is the tenth article in a ten-part series identifying the best sales techniques for 2015. To view the rest of the series, click here.

10. Make self-promotion work for you.

There’s nothing complicated about being successful in business. It’s simple and it goes like this: It’s all about making a name for yourself. That’s it, self-promotion. Getting known.

Whether it’s finding and impressing prospects, keeping current customers, or moving ahead in a career, volunteering has long been the platform for gaining visibility. For some, it’s serving on company committees and taking on extra assignments, or having a reputation as the “get it done” person.

In the community, self-promotion ranges from sponsoring or coaching youth sports teams, working charity fundraisers, belonging to a service club or fraternal organization, serving on non profit boards, chairing special events or helping with alumni and civic projects.

— John Graham, Founder, GrammCom

9. Consider the pros and cons of working with the HNW market.

A first step is to decide which HNW market segment you’ll serve. Do you want to work with the millionaire next door or the newly minted IPO billionaire? The wealth categories are arbitrary, but target market selection matters for several reasons. First, the pool of available prospects shrinks as you move up the wealth scale. The number of HNW prospects is also location-sensitive. In parts of the U.S., a $1 million net worth qualifies someone as top-tier wealthy. In other parts of the country, $1 million isn’t considered wealthy, but the number of HNW prospects is much larger.

This means competition is an important factor to consider. Every local, regional and national organization with a wealth management or private banking division wants the high-end client. Advisors have told me of cases in which they were one of a half dozen wealth managers pitching their services to HNWs who were shopping for new advisors. The playing field gets crowded when there are more competitors chasing fewer qualified prospects.

An advisor’s business offering and expertise, both current and anticipated, should also match the segment’s needs. This is the “sweet spot.” The advisor understands the market and can deliver what those clients want, because many of them fit the same profiles. From a broad perspective, retirees in the $1 million to roughly $3 million wealth range often don’t consider themselves wealthy. This group shares many of the same financial and lifestyle concerns as the mass affluent market, generally considered to be between $500,000 and $1 million. As a result, the products and services an advisor has provided successfully to mass affluent clients should continue to work with clients up to roughly the $3 million level.

— Ed McCarthy, CFP

8. Consider joining a medical or social services charitable organization.

What’s a motivated agent or advisor with limited funds to do? You’ve done the math: You intend to join four organizations and attend a meeting for each every month. At those meetings you plan on meeting six people socially and saying hello to those you met earlier. Six new connections four times a month yields 24 people. Over 12 months this yields 288 contacts. Even if a third of them don’t have assets and another third can’t stand you, this process has generated about 100 people who like you and also have business potential.

Medical charities provide a structured framework for raising money for medical research or helping the disadvantaged. These are noble causes.

Don’t: Focus exclusively on national organizations that raise money through mailings. You want organizations and events supporting the local hospitals and charities.

Do: Consider animal shelters. They might be off the radar, but they often hold great events and are popular with local movers and shakers.

— Bryce Sanders, President, Perceptive Business Solutions Inc.

7. Take pride in what you do.

Insurance agents are calling themselves “Financial Planners, “Retirement Planners,” “Financial Advisors”… everything except insurance agents.

Lawyers have a bad reputation too, but they don’t hide behind a title. They do what they do well, or they fail. Insurance agents fall prey to marketing organizations that want to make money any way they can. They talk about positioning and fancy sales techniques. The insurance industry has gone the way of the car industry. A consumer doesn’t know whom they can trust for the truth, so they’re going online for a do-it-yourself plan. The consumer has little knowledge of available products, so he will attempt to educate himself and with a great deal of luck might choose the right product.

Why not call yourself an insurance agent selling insurance? You probably won’t get rich, but you can earn a very comfortable and honest living.

— Kim Magdalein, Owner, SeminarsForLess.com

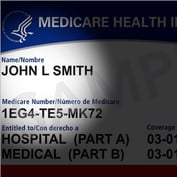

6. Understand health is wealth.

You do not have to be a doctor to provide your clients with the general tools and resources they need to better understand and manage their own personal health care costs. But if you are in the business of mitigating financial risk, then health care needs to be a topic that you are comfortable talking about. Coordinate a wellness fair in your community and invite your clients to attend the event with their friends and family. Invite physicians, coaches and other health care specialists to speak on topics that will provide your clients with general wellness awareness and interactive education based around nutrition, stress management, exercise and health care spending. By promoting health optimization for your clients, you should naturally find yourself also discussing the products necessary to ensure your clients are prepared to manage potential longevity risks or unexpected illnesses like disability insurance, life insurance, or annuities.

— Christopher Martin, Wealth and Health Advisor via Employee Benefits, Cyganiak Planning, Inc.

May 27, 2015 at 02:13 AM

May 27, 2015 at 02:13 AM