Do commodity etfs belong in your clients’ portfolios? Some advisors feel exposure to stocks, bonds, real estate and cash offers most people all the diversification and asset coverage they’ll ever need. However, other advisors are adding commodities as another major asset class.

“We do utilize commodities in our client portfolios and they make up roughly 4 percent of our standard 60/40 portfolio,” says Jeffrey E. Janson, CFP with Financial Advisory Corporation in Grand Rapids, Mich.

Many factors impact the price and cost of commodities, including geopolitical tensions, weather and war. This makes the dynamics of investing in commodities very different from investing in commodity-related equities.

Many factors impact the price and cost of commodities, including geopolitical tensions, weather and war. This makes the dynamics of investing in commodities very different from investing in commodity-related equities.

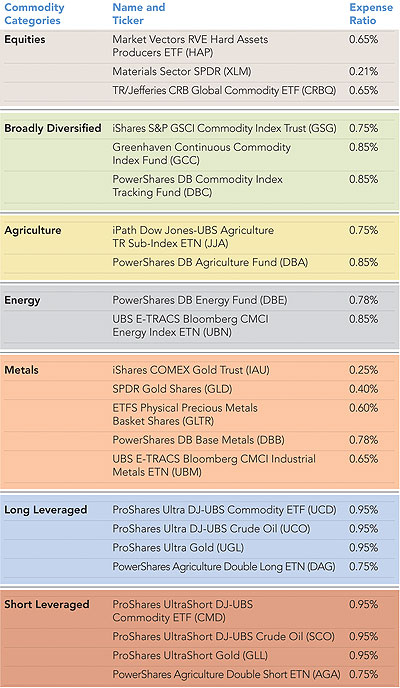

That’s one reason some advisors prefer staying with stocks. “For our model portfolios, we have a strategy of sticking to ETFs that invest in companies in the commodity industry, as opposed to investing into ETFs that invest into commodity futures or physical commodities,” states Michael McClary chief investment officer at ValMark Advisers. “We use the Vanguard Energy ETF (VDE), Vanguard Materials ETF (VAW) and the Guggenheim Timber ETF (CUT) extensively.” ValMark manages $850 million in its model ETF portfolios.

Some advisors are hesitant to use exchange-traded products that invest in commodities through futures contracts because of operational issues. These problems were exacerbated last year when the Commodity Futures Trading Commission set restrictions on positions in futures contracts that exchange-traded products could buy.

That caused some products like the iShares S&P GSCI Commodity Indexed Trust (GSG) to temporarily halt the issuance of new shares and effectively trade like closed-end funds for a period of time. Other products like the PowerShares DB Commodity Index Tracking Fund (DBC) were forced to change their indexing strategy.

“While we like the low cost that the ETFs generally provide, there are several structural issues that have caused us to decide against ETFs when looking for broad-based commodity exposure, says Janson. “These structural issues include significant energy overweighting in the index construction methodology, roll yield issues of contango and backwardation and price tracking error.”

Commodity ETFs that invest in commodity futures rather than taking delivery of the physical commodities must roll their futures positions every month into new contracts as the old contracts expire. If future commodity contracts are more expensive than spot prices, this creates a situation called contango. In this case, the commodity fund is likely to produce negative returns, as it replaces expiring contracts with higher priced contracts.

When spot commodity prices are more expensive than future prices, the opposite of contango occurs. This is known as backwardation. Steep backwardation often indicates the marketplace perception that an immediate shortage of a particular commodity is at hand.

“Ultimately, we don’t want the particular challenges that indexing commodities present to inadvertently taint our client’s view of ETFs in general,” adds Janson.

Getting Physical

Some advisors, however, are taking a more “physical” approach to investing in commodities. Consider: two metals-backed ETFs, the iShares COMEX Gold Trust (IAU) and the SPDR Gold Shares (GLD), alone command almost $60 billion in assets. Both products take physical delivery of gold bullion bars and store them in secure locations.

Another twist on the same theme is the ETFS Physical Precious Metal Basket Shares (GLTR), which owns physical gold, silver, platinum and palladium in fixed equal weights of 25 percent. GLTR’s annual expense ratio is 0.60 percent.

December 01, 2010 at 03:04 AM

December 01, 2010 at 03:04 AM