Falcon

NOT FOR REPRINT

9 Total U.S. Stock Market Funds, Ranked From Worst to Best: Morningstar

Slideshow April 15, 2022 at 03:02 PM

Share & Print

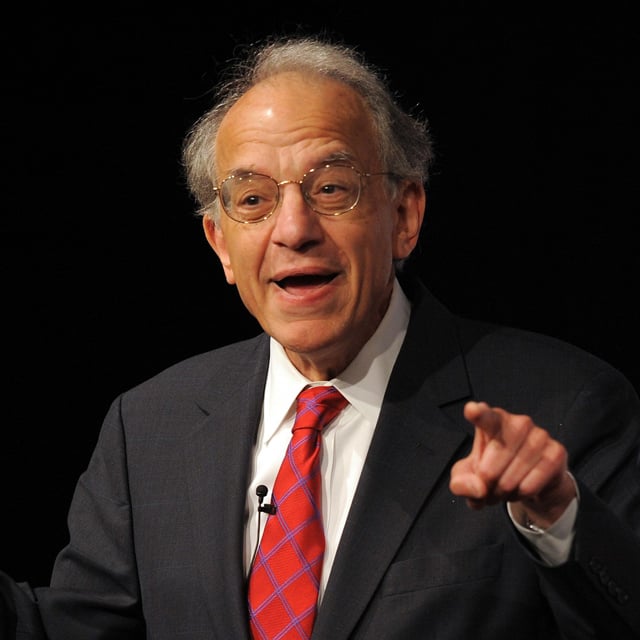

John Rekenthaler, columnist for Morningstar.com and a member of Morningstar's investment research department, recently identified the six best "true" S&P 500 index funds out of the more than 250 funds and ETFs with "500" in their names. After identifying those funds, ranking them was straightforward because they all mimicked the same benchmark. That's not the case with the nine funds that buy the entire U.S. stock market, he writes in a new blog post. Researchers no longer can look to a single total market standard, whereas in the past they invariably cited the Wilshire 5000 index. "In fact," he writes, "of the nine total stock market index funds with 10-year records (retail funds only, cheapest share class), none claims the Wilshire 5000 Index as its benchmark." The choice of index matters little, he says, as only six basis points separated the leading benchmark from the laggard for the 10 years from January 2012 through December 2021:

- Russell 3000: 16.30%

- CRSP U.S. Stock Market: 16.29%

- Dow Jones U.S. Broad Market: 16.27%

- S&P U.S. Total Market: 16.25%

- Dow Jones U.S. Stock Market: 16.24%

NOT FOR REPRINT

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.

Featured Resources

View All

Sponsored by Axos Advisor Services

Integrated Banking Solutions: How To Enhance Client Services and Grow Your Business

Sponsored by Optifino

Three Macro Trends Impacting Long-Term Care: Trends, Solutions & Client Conversations

Sponsored by Vanilla

The Missing Piece: Why Advisors Who Skip Estate Planning are Failing Their Clients