Falcon

NOT FOR REPRINT

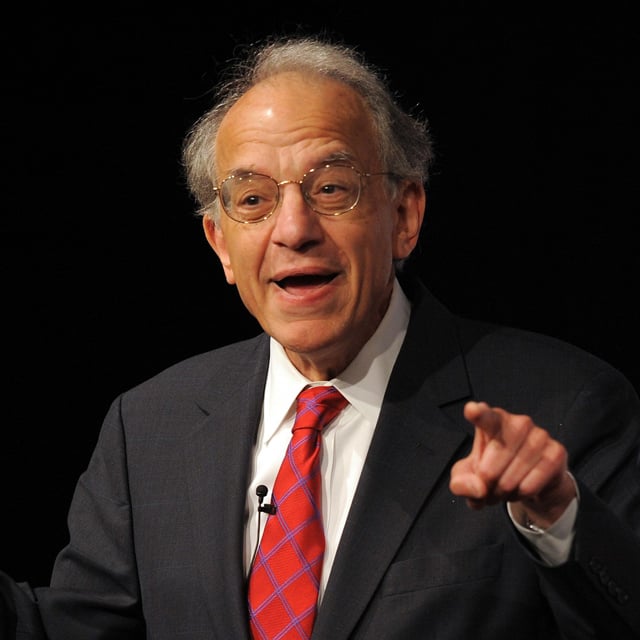

Bob Doll Checks In on His 10 Predictions for 2019

Slideshow July 23, 2019 at 03:06 PM

Share & Print

(Related: Bob Doll's 10 Predictions for 2019)

Robert Doll, the senior portfolio manager and chief equity strategist at Nuveen, made 10 predictions for 2019 around the theme that markets and economic data would be choppy, but that a recession was not in the offing nor would the bull market end. At the end of the second quarter, he reviewed those predictions and found that most of them were trending in the right direction. And what does Doll's crystal ball say about the second half of the year? He sees several reasons to be cautious in the near term toward stocks, which ended the second quarter at near record levels:- Investors have priced in prospects for lower interest rates

- The Federal Reserve has some capacity to ease rates, not so most other central banks

- A near-term U.S./China trade pact is unlikely

- Global growth is uneven, corporate earnings expectations are trending downward

- Stocks appear fully valued

NOT FOR REPRINT

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.

Featured Resources

View All

Sponsored by Manulife John Hancock Investments

Exploring Private Credit's Journey to a Trillion-Dollar Asset Class