The survey results show that treasury functions are managing their cash prudently in the face of growing volatility, notes BELLIN director, sales North America, Hung Nguyen. The findings also suggest that "uncertainty in the global economy is causing businesses to entrench and build their cash reserves to weather any financial downturn," he adds.

As more signs of a slowdown emerge, treasury leaders must determine which indicators are meaningful and which are not. "The cacophony of noises seeking to grab attention can be related to concerns about trade, speculation about interest rate adjustments, or otherwise," says Strategic Treasurer managing partner Craig Jeffery. "Treasury professionals will make adjustments based upon real events actually happening that will impact their organization."

In the coming months, this practicality will need to be applied to companies' levels of cash reserves, adjustments to the mix of cash and short-term investments (including overseas holdings), and a range of internal technology, talent, and risk management challenges. "Continued headwinds from low interest rates globally, coupled with increased pressure from global regulators and the investor community," notes Ken Thomas, a managing director with Protiviti, require "treasury functions to be balanced and innovative in managing their company's cash and solvency."

Cash Reserves Rising

The "2019 Cash Management Survey" was completed in September by treasury executives across all industries. Twenty-nine percent of respondents work in companies with annual revenues of less than $100 million; 22 percent earn $100 million to $1 billion; 29 percent have revenues of $1 billion to $10 billion; and 27 percent exceed $10 billion.

The survey's most compelling results, according to BELLIN head of customer advisory Rüdiger Schlecht, include the fact that far more organizations increased cash reserves in the past year (42 percent) than reduced cash reserves (22 percent). See Figure 1.

Source: "2019 Cash Management

Survey," Treasury & Risk.

Source: "2019 Cash Management

Survey," Treasury & Risk.

Schlecht holds up two of the survey's other findings as also noteworthy: First, that nearly two-thirds of responding organizations (62 percent) are net investors as opposed to net borrowers (38 percent). And second, that 31 percent of global companies plan to reduce, during the next year, the portion of cash and short-term investments that they hold abroad.

Overall, the survey found that companies continue to increase their cash reserves, which likely reflects a response to an increasingly uncertain global business environment, Nguyen notes. He also points out that some companies are tempering their pace of growth in response to the global slowdown. Some of these companies may have begun reducing capital expenditures more than a year ago, "and we're now seeing the effect of growth slowdown," Nguyen adds.

Michael Kolman, ION Treasury Chief Strategy Officer for ION Treasury, agrees. "Uncertainty related to geopolitical risk is having a notable impact on cash management practices across industries this year, and we expect that to continue," she says. "Another related external factor that is affecting cash management—and particularly cash pooling around the world—is the shifting tax and regulatory landscape."

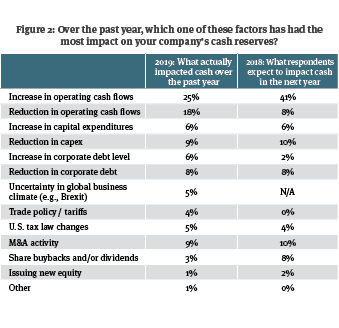

Increases in operating cash flows (cited by 25 percent of respondents), reductions in operating cash flows (18 percent), reduction in capital expenditures (9 percent), merger and acquisition (M&A) activity (9 percent), and reduction in corporate debt (8 percent) mark the factors that survey respondents said had the most influence on their corporate cash reserves in the past year. When comparing the 2019 results against last year's survey results, it is worth noting that more organizations experienced a reduction in operating cash flows in 2019.

It is also notable that the proportion of companies reducing corporate debt (8 percent) and/or reducing capital expenditures (9 percent) in 2019 effectively doubled compared with the 2018 iteration of the same survey. These reductions in capex and corporate debt, Nguyen says, are a "clear signal that companies are wary of uncertainty in the business climate" and are "shoring up their balance sheet to weather any adverse financial downturn in the economy." See Figure 2.

Source: "2019 Cash Management

Survey," Treasury & Risk.

Source: "2019 Cash Management

Survey," Treasury & Risk.

When treasury professionals project how they expect their organization's cash reserves to change in size during the next year, 41 percent expect reserves to increase, 43 percent project no significant change, and 17 percent expect a decrease (with roughly three-quarters of that final group expecting a decrease of less than 10 percent). However, compared with the 2018 survey, significantly fewer respondents said they expect cash reserves to increase by more than 10 percent over the next year—13 percent in 2019, vs. 29 percent in 2018.

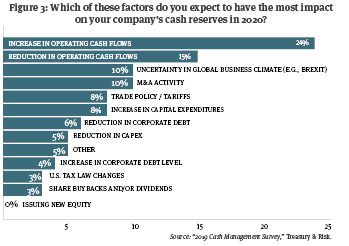

The factors that respondents expect to influence their cash reserves in the future also changed significantly. In last year's survey, 41 percent of respondents indicated that increases in operating cash flows would have the largest influence on corporate cash in the coming year. This year, however, only 24 percent of respondents expect increases in operating cash to have the most significant impact on cash reserves. Additionally, nearly twice as many respondents this year (15 percent in 2019, vs. 8 percent in 2018) expect a reduction in operating cash flows to have the largest impact on their cash reserves over the next year.

"It suggests that companies are slowing down their pace," Nguyen reports, "and some effect of the global business slowdown may already be taking hold." This year's survey respondents also think that uncertainty in the global business climate (due to events such as Brexit), as well as trade policy and tariffs, will have a much greater impact on cash reserves during the coming year than last year's respondents predicted. See Figure 3.

Source: "2019 Cash Management Survey,"

Treasury & Risk.

Source: "2019 Cash Management Survey,"

Treasury & Risk.

Other external factors also appear likely to exert significant impact on any internal decision-making concerning cash reserves in 2020, notes Jeffery, who points to the growing negative interest rates earned after inflation and an "economic deceleration in Europe spreading to other markets and creating a feedback loop."

Read The Future of Cash Management by

BELLIN

Read The Future of Cash Management by

BELLIN

More Cash Management Challenges

Allison Flexer Hughes, financial management senior manager within Grant Thornton LLP's business consulting practice, sees companies' ability to react effectively to tariffs, political volatility, and/or a downturn as hinging on the quality of forecasting processes. If there is a prolonged downturn, "treasury leaders should be ready to participate in, and provide supporting data for, reviews of internal functions and business units to identify which are critical to core operations," she says. "Organizations may consider the sale of underperforming assets and business units, which would require treasury's input on which businesses are the most efficient users of capital and generators of profit."

Delivering that data requires the right technology, which figures prominently among the secondary issues and challenges affecting cash management capabilities:

- Regulatory requirements. A source of pain for years, regulatory compliance requirements continue to increase and intensify. Corporate treasury groups and bankers are especially burdened by activities related to KYC (Know Your Customer), reports Jeffery. In most cases, companies are solving these challenges within their organization, he reports, adding that "the pain is increasing at escalating rates." Protiviti's Thomas adds that the highly regulated nature of cross-border cash management activities also marks an ongoing challenge.

- Fraud. "Payment fraud continues to grow increasingly automated, sophisticated, and adaptive," Jeffery reports. "This has led to more attacks and a greater level of financial success" for the attackers. In response, Jeffery and his team expect more organizations to invest in anomaly-detection tools, conduct more training and testing around payment security, and assess and strengthen end-to-end payment processes.

- Cybersecurity. Payment fraud is often perpetrated via cybersecurity breaches, another challenge for increasingly digital treasury functions—and one which ION's Sreepada says treasurers are focusing on as a critical issue this year. Grant Thornton's Hughes agrees. "As businesses engage in digital transformation and make use of open networks and other future-ready services from banking partners, they will be exposed to new and diverse risks and cybercrime," Hughes notes. "Leaders must balance decisions about adopting advancing digital technology and banking solutions with the risks inherent in these opportunities."

- Treasury technology. External volatility and uncertainty make it even more important for treasury functions to gain better visibility into their cash positions. This need, BELLIN's Schlecht emphasizes, is driving treasury functions to evaluate new or upgraded treasury management systems. Payment complexity—driven by global growth, foreign exchange volatility, payment advances, and the growing threat of fraud—is challenging existing treasury technologies. "Treasury, A/P, and IT groups now have to support an escalating level of complexity with limited resources," Jeffery says. "They know they shouldn't have to solve the same problem in four or five different underlying systems."

- Talent. New cloud-based solutions, application programming interfaces (APIs), open banking, and robotic process automation (RPA) all require new skills. "Bank APIs, enabling real-time updates of bank balances and transaction data, and machine learning applications for better forecasting and fraud detection are reshaping the treasury function," Sreepada says. According to Hughes, the implementation of some of these advanced technologies creates a talent challenge for many traditional treasury functions. "New required skill sets have emerged," she says, noting that treasury functions "will need to respond by changing role definitions, performance expectations, and hiring plans."

Banking relationships. Some treasury consultants point to declining levels of satisfaction with banking partners' payments-related services. Given the need for increased speed and treasury functions' drive to improve end-to-end payment processes, some banking relationships are "creating levels of friction not seen in recent times," Jeffery observes.

Read The artificial intelligence and machine

learning revolution by ION

Read The artificial intelligence and machine

learning revolution by ION

Adjusting Investment Priorities and Policies

Given the variety of internal and external issues currently challenging cash management activities, it is not surprising that corporate treasurers continue to favor approaches and investment allocations that safeguard principal and increase immediately available liquidity.

The investment priorities that this year's survey respondents identified are notable in that they illustrate an even stronger desire to protect principal—that is the top short-term investment goal in this year's results (and the third-highest priority in the 2018 results). The proportion of respondents who selected "eliminating any chance of lost value in principal" as their top priority doubled in 2019. "Understanding and mitigating the impact of geopolitical uncertainty" is also the top priority for a far larger proportion of 2019 respondents (16 percent) than 2018 respondents (6 percent). "I think the priority of 'eliminating any chance of lost value in principal' may move even higher if uncertainty in the business climate increases over the coming months," Nguyen says. See Figure 4.

Source: "2019 Cash Management Survey,"

Treasury & Risk.

Source: "2019 Cash Management Survey,"

Treasury & Risk.

As treasury groups in global companies work through these priorities, they are not planning to repatriate a lot of funds. Among the respondents whose companies have cash or short-term investments overseas, 64 percent indicated that the proportion they hold abroad will not change significantly over the next year. Sixteen percent of respondents expect to make a small reduction in cash held abroad, 15 percent a significant reduction, and 5 percent plan a small increase.

Not surprisingly, most companies (66 percent) are storing most of their cash in bank deposits, including CDs and time deposits. When it comes to other investment vehicles, the most popular options are prime money market funds (MMFs), government/Treasury money funds, and Treasury bills; they hold at least 10 percent of cash and short-term investments for 32 percent, 21 percent, and 23 percent of respondents, respectively. "Risk aversion features prominently in terms of where the companies choose to hold their deposits and investments," Nguyen notes. "Despite the low yield, companies are not deviating far from their traditional bank deposits and money market investments."

ION's Sreepada finds it interesting that about a third of companies are holding at least 10 percent of their short-term investments in prime MMFs. "Money flowed out of prime funds in 2016, when the floating NAV [net asset value] was introduced," she points out. "Now it appears that companies are more open to these investments. As more and more companies explore MMFs as investment options, they should look to invest in these securities electronically. Doing so can save time, improve accuracy, and automate maintenance of these investments, which eases complexity of managing floating-NAV funds."

Most treasury functions are standing pat when it comes to making changes to investment policies for cash and short-term investments. The policy adjustments (conducted in the past three years) that 2019 survey respondents cited most frequently track closely to the policy adjustments that 2018 respondents identified. In fact, the most common response (cited by 41 percent of 2019 respondents) is that their company has not changed its investment policy at all. The other frequent policy changes in the 2019 survey include:

- Eliminated prime money funds as cash investment option (20 percent);

- Added new asset classes (14 percent);

- Increased enforcement of investment policy (13 percent);

- Shortened allowable maximum maturities (11 percent); and

- Raised minimum credit rating for counterparties (9 percent).

Treasury teams should not lose sight of the fact that even bank deposits carry some risk, Sreepada emphasizes. "Corporate investment policies haven't changed significantly, and companies appear to be keeping investment tenors short," she notes. "They are investing primarily in short-term instruments or keeping cash in banks. But keeping cash in banks introduces the critical need to understand counterparty exposures."

Despite the growing uncertainty complicating cash management decisions, corporate treasurers can count on a couple of sure things. First, signals concerning the global business environment's future trajectory will sharpen in the coming months. The International Monetary Fund recently reduced its projection of world economic growth in 2019 from 3.6 percent to 3 percent, the lowest growth rate since the financial crisis. And second, the noise will get louder.

As such, Nguyen suggests that treasury functions "seize the moment" by making the process improvements and technology investments they need to help "achieve greater efficiency, visibility, connectivity, and security"—all of which will be extremely practical when the downturn arrives.

Also from the November 2019 Special Report:

Sponsored

Statement—BELLIN: The Future of Cash Management

Sponsored

Statement—BELLIN: The Future of Cash Management

Sponsored Statement—ION: The artificial intelligence and machine learning revolution

View the November 2019 Digital Edition here

Eric Krell's work has appeared previously in Treasury & Risk, as well as Consulting Magazine. He is based in Austin, TX.

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.