What You Need to Know

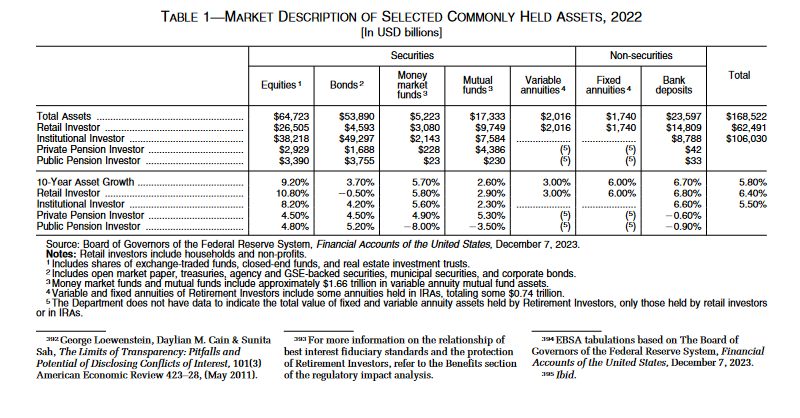

- Labor analysts included a puzzling asset comparison table in the final fiduciary standard update packet.

- The table shows fixed annuity assets growing twice as fast as mutual fund assets.

- The numbers look strange to some annuity professionals because the analysts used Fed asset totals, not investment yield data.

Labor Department regulation analysts recently shocked the U.S. fixed annuity community.

The department set tough new retirement account rollover advice fiduciary standard requirements.

The department also reported that, as of 2022, 10-year asset growth had been 6% for fixed annuities, 3% for variable annuities and just 2.9% for mutual funds.

Stocks ranked first, with 10-year asset growth of 10.8%, but humble bank deposits ranked second, with 10-year growth of 6.8%.

Retail investors’ mutual fund assets had a growth rate of 2.9%, while bonds had a negative growth rate, a decrease of 0.5%.

Credit: U.S. Department of Labor’s investment advice fiduciary final rule packet.

Credit: U.S. Department of Labor’s investment advice fiduciary final rule packet.

Annuity professionals asked each other and ThinkAdvisor: How could fixed annuity assets grow faster than mutual fund assets?

The answer: Labor Department analysts used different kinds of data than retail investment advisors usually use when monitoring product performance.

Retail comparisons: Investment advisors who help clients compare the performance of various types of investments often provide tables or charts that focus on how much the value of a certain asset class has increased or decreased due to market shifts.

For stocks, they might use the S&P 500 stock index or a similar stock index.

The DOL table: Labor Department fiduciary regulation impact analysts included the retirement asset snapshot table to give users a rough idea of what kinds of assets retail investors are using and how the asset totals are changing.

Instead of using the kinds of investment index figures that typically show up in news reports or investment advisor presentations, the department analysts pulled data from the Federal Reserve System’s Financial Accounts of the United States reports.

The Fed publishes the financial accounts reports, which are also known as the Z.1 reports, every three months. The edition the Labor Department impact analysts used was published Dec. 7.

May 06, 2024 at 04:11 PM

May 06, 2024 at 04:11 PM