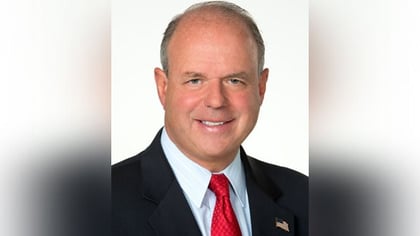

Cetera Financial Group’s news that CEO Robert “RJ” Moore is stepping down for health reasons is raising lots of questions from industry insiders.

The development comes less than four months after the private-equity firm Genstar Capital acquired a majority stake in Cetera, which has more than 7,000 affiliated independent advisors, and a series of changes and much-publicized issues in recent years.

“They have weathered so many storms, and it seemed like they finally had bluer skies ahead. Now there’s another storm,” said industry consultant Jeff Nash, CEO of Bridgemark Strategies.

Industry consultants and recruiters are asking what’s next for leadership, as well as for retention and recruiting at the group of independent broker-dealers.

“Who will they bring in?” asked recruiter Jon Henschen. “You need a visionary, charismatic leader who is good at building consensus and rallying advisors together.”

According to the independent broker-dealer group, Moore does not have a terminal illness. Chairman Ben Brigeman will take over as CEO on an interim basis on March 31, while the executive search firm Heidrick & Struggles helps the independent broker-dealer group permanently fill the position.

“Why not [Cetera President] Adam Antoniades, who has a lot of those qualities?” Henschen said. “I would have thought they would move Adam in [to the CEO role] given his deep understanding of the industry and Cetera’s competitors.”

The IBD group is not disclosing details about its CEO search. It said in a statement: “The board has complete confidence in the capabilities of Adam Antoniades in his role as president, in which he is primarily focused on driving forward Cetera’s aggressive growth goals, as well as overseeing strategy and innovation for the organization.”

Still, Henschen says, Antoniades has been in an executive role “throughout all the battles — he’s got the background and is good at talking with advisors, so I thought they would promote from within.”

Antoniades has been president of Cetera since April 2014 and of First Allied Securities since 1994. “Maybe he is not interested because of time demands,” Henschen said.

But Nash thinks there is more to the situation. “They could add him as a candidate to the pool” of potential CEOs, he explained. “There is a lot of talent in the marketplace, so it makes sense they did not automatically move him into that role.”

Could Cetera be looking for an executive with experience leading a publicly traded broker-dealer? Not necessarily, according to Nash.

“LPL Financial President and CEO Dan Arnold did not run a public company before he was tapped for the CEO slot,” the consultant said. “He had very little experience as the CFO of a public company [at LPL] and then became president and later CEO.”

While Nash sees Antoniades as an executive who “certainly knows the advisors and the company” he helps lead, “I see the logic in looking around to find a better CEO who can turn the company around.”

February 20, 2019 at 02:45 PM

February 20, 2019 at 02:45 PM