UnitedHealth Group Inc. kicked off the second-quarter earnings season for life and health insurers Tuesday by releasing earnings that were fine.

The Minnetonka, Minnesota-based company reported $3 billion in net income for the quarter on $56 billion in revenue, compared with $2.4 billion in net income on $50 billion in revenue for the second quarter of 2017.

The company — which presents itself as a data analysis company, and a manager and improver of health care, but still gets about 79% of its revenue from insuring people against health risk — ended the quarter providing or administering health coverage for 49 million people, up from 47 million people a year earlier.

(Related: UnitedHealth Leaves You Off Its Emphasis List)

Here’s what happened to enrollment in key coverage categories:

- Commercial, fully insured group plan enrollment in the United States increased to 7.9 million, from 7.8 million.

- International medical enrollment increased to 6 million, from 4.1 million.

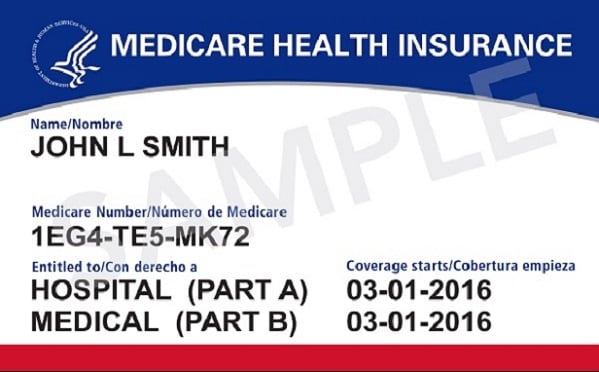

- Medicare Advantage plan enrollment increased to 4.8 million, from 4.3 million.

- Medicaid plan enrollment increased to 6.7 million, from 6.4 million.

- The number of Medicare supplement insurance insureds, or Medigap insureds, increased to 4.5 million, from 4.4 million.

- The number of individual major medical insureds fell to 480,000, from 540,000, in part because of the company’s retreat from the Affordable Care Act public exchange system.

Here are five things that came up during a conference call the company held to go over the results with securities analysts, with the gist of each of the key points condensed to 280 or fewer characters.

1. All of the fuss in Washington about the Affordable Care Act is creating “headwinds.”

Headwinds are bad for earnings.

2. Getting to be such a big Medicare Advantage plan creates headwinds.

UnitedHealth executives are seeing Medicare plan care utilization rates rise, partly because they company covers so many Medicare enrollees. The plans are holding on to the enrollees as they age, and end up needing more care.

3. Executives sound happier about the insured commercial major medical plan market.

“That environment is competitive,” Dan Schumacher, president of the UnitedHealthcare unit, said. ”

The company returned to growth in the fully insured group market in the second quarter, and “ had nice contributions across all market segments, from individuals and small groups, and through the middle market as well,” Schumacher said. “We always have pockets of competition that we’re responding to.”

The fact that UnitedHealthcare is in so many parts of the country, and has both fully insured and self-funded plan administration operations, helps the company cope with the competition, Schumacher said.

4. UnitedHealth’s move to join the Massachusetts ACA public exchange comes with a footnote.

Executives denied that the company has strong new interest in the ACA exchange program.

For regulatory reasons, the company had to join the Massachusetts exchange because of its high market share in the state’s small-group market, according to David Wichmann, UnitedHealth’s chief executive officer.

5. UnitedHealth is not focusing on the Trump administration’s new association health plan and short-term medical rule changes.

Neither UnitedHealth executives nor the securities analysts mentioned the AHP market or the short-term medical market.

— Read 5 Wild Cards That Could Brighten Q2 Life and Annuity Issuer Earnings, on ThinkAdvisor.

— Connect with ThinkAdvisor Life/Health on Facebook and Twitter

July 18, 2018 at 01:31 PM

July 18, 2018 at 01:31 PM

Slideshow

Slideshow