Sen. Bill Cassidy is back in the news with a new proposal for improving the U.S. health care finance system.

The Louisiana Republican is a board-certified medical doctor. He joined the Senate in 2008, and he has been active in health policy since he came aboard.

In 2016, he launched a major effort to overhaul the current Affordable Care Act system. He proposed expanding use of health savings accounts and replacing the current income-based ACA individual major medical premium tax credit subsidy with an age-based subsidy.

(Related: Trump’s ACA World)

Cassidy helped win support for his 2016 proposal from a small army of professional sales veterans by presenting the proposal at a conference organized by Health Agents for America.

Over the past year, he has tried to come up with compromise proposals for stabilizing the current ACA system while preparing to move the country to something else.

Now, he is continuing his health system change fight with a new commentary paper that calls for Congress to improve the situation by taking action in six areas:

1. Empowering patients to reduce their health care costs. 2. Lowering health insurance premiums. 3. Ending health care monopolies by increasing competition. 4. Decreasing drug costs for patients. 5. Eliminating administrative burdens and costs. 6. Reducing costs through primary care, prevention, and chronic disease management.

A copy of the paper is available here.

Cassidy includes ideas that could affect commercial health insurance, and commercial health insurance agents and brokers, throughout the paper. In the administrative burdens section, for example, he calls for eliminating the current ACA employer coverage mandate and employer coverage reporting requirements.

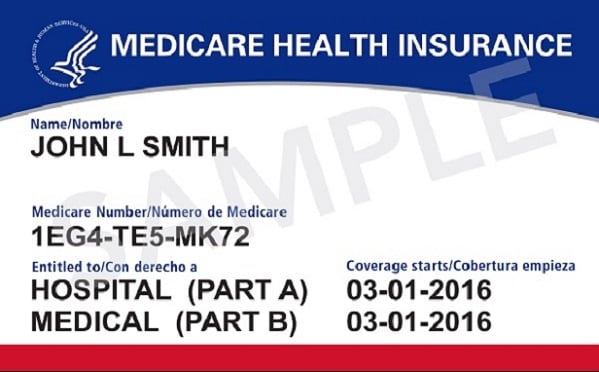

He also has ideas about how to improve the health savings account program. (See the idea card gallery above.) The HSA program lets people who have major medical coverage that meets HSA program requirements contribute cash to HSAs, and use the HSA cash to pay for medical products and services, without paying federal income taxes on either the contributions or the withdrawals.

The section with the most direct impact on commercial health insurance, for example, might be the section that focuses on ideas for lowering health insurance premiums.

Even if Congress does not end up adopting Cassidy’s recommendations, his ideas may help shape the framework for how Congress returns to the health system change debate.

Here are three ideas from that section.

1. Stabilize the current system.

Cassidy says Congress should pass the Bipartisan Stabilization Act, a bill authored by a team of four senators: Lamar Alexander, Patty Murray, Susan Collins and Bill Nelson.

That bill would fund the ACA cost-sharing reduction subsidies, give states greater flexibility to adjust ACA rules, allow for interstate health insurance sales, provide federal funding for reinsurance or invisible high-risk pools, and offer all purchasers of individual major medical coverage access to plans that cover just 50% of the actuarial value of the ACA’s “essential health benefits” package, or core benefits package.

Cassidy predicts passing that bill could cut premiums by about 40% compared with the levels now projected.

Many Republicans oppose the cost-sharing reduction subsidy funding proposal.

Many insurers, state insurance regulators and Democrats have argued that the interstate health insurance sales proposal would backfire, by encouraging insurers to base their operations in the states with the mildest rules and regulatory efforts.

2. Let patients buy coverage better tailored to meet their needs.

Cassidy suggests, for example, that Congress could codify the Trump administration’s effort to increase the maximum duration for short-term health insurance to 364 days.

The current limit, which was adopted under former President Barack Obama, is 90 days.

Obama administration officials adopted the duration limit partly because they wanted to avoid letting short-term health insurance, which falls outside the reach of the ACA individual major medical underwriting and benefits rules, from crowding out individual major medical coverage.

“These plans aren’t the solution for everyone, but affordability correlates with purchasing insurance, so these plans will allow some uninsured individuals to enroll in a plan they can afford and provide them the protection they need in the event of an accident,” Cassidy writes in his paper.

This proposal could lead to conflicts between insurers, and especially between the insurers that offer short-term health insurance policies and the insurers that do not. Some insurers have welcomed the idea of more flexible short-term health insurance rules; others see the existence of less-regulated alternatives to major medical insurance as a threat to the existence of high-quality major medical coverage.

3. Help young adults — and, possibly others — pay for their coverage.

Individual major medical coverage is just too expensive for many young, healthy Americans who earn too much to qualify for large ACA premium subsidies, Cassidy writes.

“By incentivizing these presently uninsured individuals to enroll in the marketplace through additional premium assistance, we can increase coverage and reduce health care costs for all Americans in the individual market,” Cassidy writes. “States should also be given additional flexibility to experiment with other techniques and incentives to help individuals enroll in coverage.”

— Read also, on ThinkAdvisor:

- Lamar Alexander Keeps the Individual Health Rescue Fight Alive

- Insurers Join Hospitals, Doctors Opposing Graham-Cassidy ACA Bill

- Collins and Cassidy unveil partial ACA repeal bill

— Connect with ThinkAdvisor Life/Health on Facebook and Twitter.

May 31, 2018 at 01:37 PM

May 31, 2018 at 01:37 PM

Slideshow

Slideshow