The American Council of Life Insurers (ACLI) today celebrated the birth of the U.S. Securities and Exchange Commission’s own fiduciary rule draft.

SEC members voted 4-1 this afternoon to put the draft through a 90-day public comment period.

(Related: SEC Approves Fiduciary Rules)

SEC Chairman Jay Clay said the SEC ought to move to fill the gaps between investor expectations of broker-dealers and investment advisors and the legal requirements, in a way that would coordinate the SEC’s actions with the actions of the SEC’s fellow financial services regulators.

Critics of the SEC proposal say it would replace the requirements the U.S. Department of Labor (DOL) fiduciary rule has imposed on financial professionals’ actions with disclosure requirements.

Sellers of annuities have objected to the special “best interest” requirements the DOL has tried to impose on sellers of indexed annuities.

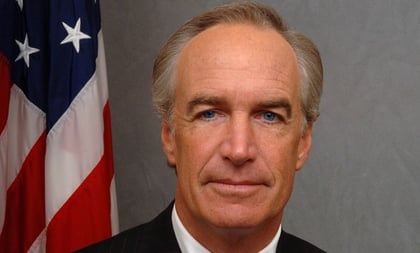

Dirk Kempthorne, the president of the ACLI, said in a statement that the ACLI welcomes the SEC’s efforts.

“We are encouraged by the SEC proposal to implement a best interest standard of conduct that can be uniformly applied across all regulatory platforms — the states, FINRA, and the Department of Labor,” Kempthorne said in the statement. “ACLI strongly supports comments made by SEC Chairman Clayton at the meeting about the need for regulatory coordination. ”

April 18, 2018 at 06:28 PM

April 18, 2018 at 06:28 PM