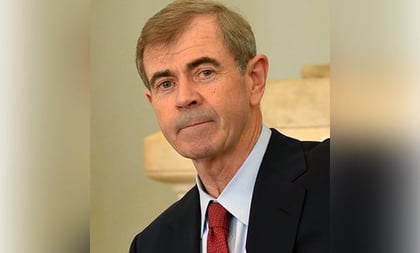

William Galvin, the top securities regulator in Massachusetts, said Tuesday that he has ordered five firms purportedly utilizing blockchain technology to halt their offering and selling of unregistered securities in the state via social media platforms like Twitter and YouTube.

The halt is a result of an exam sweep Galvin launched in mid-December of entities based in Massachusetts raising money from initial coin offerings.

The five firms were promoting virtual coins in Massachusetts, according to Galvin. The Massachusetts Securities Division entered into consent orders with: Mattervest Inc. of Belmont, Pink Ribbon ICO of Marston Mills, Across Platforms Inc. of Boston, Sparkco Inc. of Cambridge, and 18 moons of Newton.

The firms were offering and promoting the ICOs through Twitter, Reddit, YouTube and other social media sites.

Galvin ordered the firms to stop offering and selling unregistered securities and to offer rescission to anyone sold unregistered securities. Each firm’s final order included a censure.

A spokesperson for Galvin’s office told ThinkAdvisor on Tuesday that the commonwealth secretary “has put together a team of enforcement attorneys to police this [ICO] area, and their work is ongoing.”

March 27, 2018 at 11:40 AM

March 27, 2018 at 11:40 AM