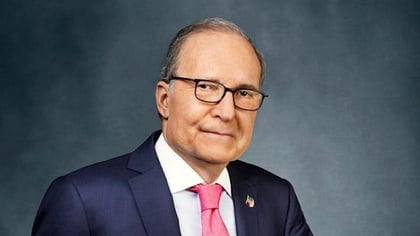

Larry Kudlow, the newly appointed White House economic advisor, has made it clear that he supports a strong dollar. Minutes after his appointment on March 14, he even offered a trade based on his policy ideas: “I would buy King Dollar and I would sell gold.”

History suggests that if Kudlow is able to follow through with his policies to create a stronger dollar, this trade will likely work out for investors. From 1974 through the end of 2017, a Federal Reserve index tracking the dollar has increased in 25 calendar years and fallen in 19 of those annual periods. The average annualized returns for gold when the dollar was up in a given year was minus 1.7%. In the years when the dollar index finished down, gold was up an annualized 16.4%. So gold does much worse in a rising dollar environment. In fact, the correlation of the prices of gold and the dollar is minus 0.6 since 1974, signaling a strong inverse relationship between the two.

A strong dollar would also likely benefit U.S. stocks but hurt foreign shares held by U.S. investors. Those who own international stocks are subject to currency fluctuations. You’re subject to the fluctuations of the local currency in which you invest when it gets converted into dollars, unless you’re invested in a currency-hedged fund. When the dollar is strong it can hurt your international holdings and when the dollar is weak it can help them.

The performance of the dollar, U.S. stocks and foreign stocks by decade offers a clear picture of this relationship:

You can see a pattern when comparing foreign and U.S. stocks to the dollar’s performance. Stocks outside of the U.S. outperformed in the 1980s and the 2000s when the dollar index fell; they underperformed the U.S. when the dollar rose in the 1990s and so far in this decade.

A rising or falling dollar in any given year doesn’t appear to have much of an impact on U.S. stocks. Since 1974, the S&P 500 had an average annual return of 11.6% in years when the dollar rose. And when the dollar fell the S&P was up 10.4% per year, a small difference. But foreign stocks have seen a huge divergence between up and down annual periods in the dollar. When the dollar rose, the MSCI EAFE was up just 4.7% annually while down years in the dollar saw foreign stocks gain 16.7% a year.

March 20, 2018 at 02:28 PM

March 20, 2018 at 02:28 PM