What You Need to Know

- Overall, prices rose 8.5% in March from a year earlier, according to CPI data released Tuesday.

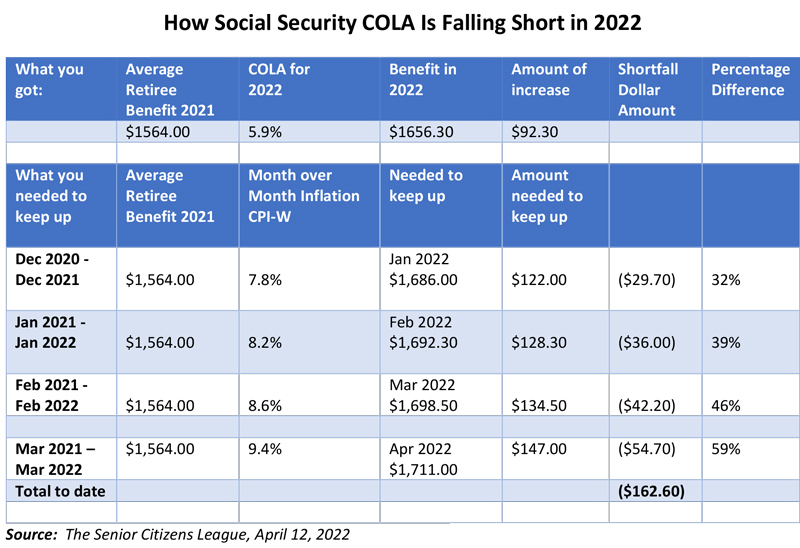

- Annual COLAs are based on inflation in the third quarter; Social Security recipients got a 5.9% raise for 2022.

- The average Social Security recipient has lost $162.60 in purchasing power so far in 2023, according to Mary Johnson of The Senior Citizens League.

Tuesday’s consumer price index release shows that prices over the past 12 months through March have risen by 8.5% — the largest 12-month increase since January 1982 and 1.2% from February to March. This estimate includes some of the price jumps, especially in energy, due to Russia’s invasion of Ukraine.

Based on this data, the Senior Citizens League estimates the Social Security cost-of-living adjustment, or COLA, for 2023 could be 8.9%. This would be the biggest COLA since 1981.

Mary Johnson, the league’s Social Security and Medicare policy analyst, bases monthly COLA estimates on changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers, known as the CPI-W. In February, the league pegged the 2023 COLA at 7.6%.

The Social Security Administration uses average inflation in the third quarter, based on the CPI-W, to calculate the benefit adjustment for the following year. The COLA was 5.9% in 2022.

David Kelly, chief global strategist of J.P. Morgan Asset Management, stated in a report Monday that while “surging energy prices due to Ukraine” are a big driver of rising prices, “broader inflation pressures are building.”

His forecast: “Strong gains in wages, rents and inflation expectations should keep inflation stubbornly high with core consumption deflator inflation averaging 4.0% year-over-year by the fourth quarter of 2022.”

The biggest price increases were in gasoline, shelter and food. Gasoline rose 18.3% in March, which “accounted for over half of the all items monthly increase,” according to the U.S. Bureau of Labor Statistics. The food index rose 1%, and the shelter index rose 0.5%.

The index less food and energy rose 0.3% in March, following a 0.5% increase the prior month. For the past 12 months, items less food and energy index rose 6.5%, the largest 12-month change since August 1982, according to the Bureau.

April 12, 2022 at 10:35 AM

April 12, 2022 at 10:35 AM