Advisors who become experts in Social Security benefit timing and filing as part of their practice really add value to their firm and their clients’ retirement plans, specialists say.

Even the Social Security Administration admits it falls short on optimizing benefits planning. In fact, in a sample of 100 retirement beneficiaries, 69 were eligible for higher survivors benefits, found the SSA’s Office of inspector General in a June study. Of those 69 surviving spouses, 49 were eligible for about $630,000 in survivors benefits.

This oversight occurred, said the OIG, because 1) SSA employees did not always assess and take action when cases were alerted for possible payment increases, and/or 2) they did not have processes to detect beneficiaries potentially eligible for higher survivors benefits.

The review also found that 15,076 retirement beneficiaries were eligible for $193.8 million in survivors benefits as of September 2019. Plus, an estimated 12,615 of these beneficiaries could lose an additional $530.9 million in survivors benefits over their lifetimes.

Advisors who specialize in this area have found that working with clients — not just widows and widowers — on when to file for Social Security could mean the difference of more than $100,000 in lifetime benefits that are missed.

But surviving spouses are regularly missed, says Joe Elsasser, founder and CEO of Covisum, a software firm that created a Social Security timing solution for advisors. He is also a certified financial planner with his own advisory in Omaha, Nebraska.

Widowed spouses can claim survivors benefits for a period of time and then later switch to their own retirement benefit or visa versa, he adds.

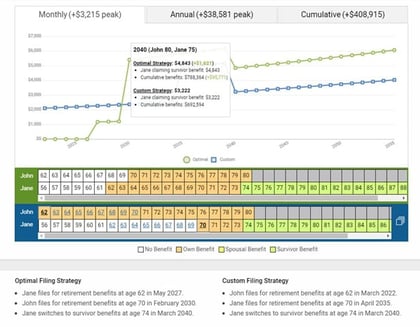

“The first step for advisors in where they add value is just identifying the options and quantifying the value between the options. And software is well suited to do that,” he says.

Elsasser’s software, called Social Security Timing, came about as a way to simplify his spreadsheet method of calculating the best timing for his own clients, as no software was available at the time (around 2009).

Married couples, surviving spouses and divorced people all come with different “complexities,” he says. ”Once you start to get into all the nuances around Social Security, you see there is just a ton of value in specializing in that because it’s such a core decision for the mass affluent, even the affluent retiree,” he says. “It’s a regular thing to find a $100,000 spread — present value — between an optimal claiming decision and someone just claiming early, which was always the default, especially 10 years ago.”

July 17, 2020 at 03:00 PM

July 17, 2020 at 03:00 PM