In the most recent bull market, passive investments outperformed actively managed funds, leading many to question whether the added costs of active management are worth it. Inflows into passive investments led to a milestone event in September 2019 in which the assets of U.S. index-based equity mutual funds and ETFs surpassed actively managed funds for the first time. Even active investing icons Warren Buffet and Peter Lynch recently conceded that passive management would likely become the way of the future.

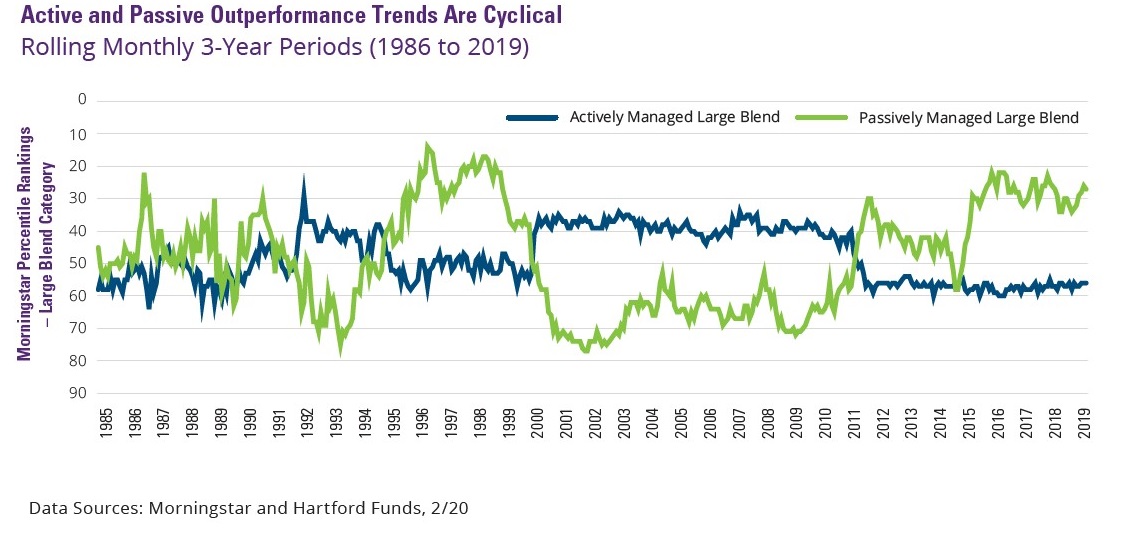

But a look at the last 35 years shows that active and passive investing are cyclical, trading places in terms of their outperformance over large periods of time. As one fund manager observes, “Just when it seems that active or passive has permanently pulled ahead, markets change, performance trends reverse and the futility inherent in declaring a ‘winner’ in active vs. passive is revealed anew.” The magnitude of disruption we’ve seen in the wake of COVID-19 may well have set the stage for a shift in the cycle.

3 Factors Favoring Passive Investing Are Now in Flux

In the past, three sets of characteristics have given passive investments an advantage:

1. Low Stock Dispersion

When the dispersion of stock returns is low, fewer companies pull ahead of the pack. Lower dispersion levels can be common in markets like we’ve just experienced in which “a rising tide lifts all boats.” Today, the tide has gone out and dispersion levels are rising, giving active managers with strong stock-picking skills more opportunity to generate alpha.

2. High Stock Correlations within Equity Style Boxes

Over the last 11 years, large cap equities have experienced above normal correlations, with share prices moving more on macroeconomic news about central bank action and trade negotiations than on changes in company fundamentals. In the aftermath of COVID-19, the health of individual companies will likely matter more, playing to the strengths of active managers.

3. Market Dynamics Favoring U.S. Large Caps

Passive investing tends to win in bull markets like we’ve just experienced, where large-cap stocks outperform small caps and where U.S. equities outperform international stocks. These dynamics, along with almost everything else, are likely to change.

The Active Manager Tool Belt Is Better Suited to Volatile Times

When markets become volatile, the agility and flexibility of active management can become a competitive advantage. Kathy Carey, director of research at wealth management firm Baird, explains, “The last bull market favored U.S. large caps. That was a good time to be in a low-cost, passive investment that was participating in the market’s movement. But when you have the kind of volatility like we’ve seen recently, that passive investment is going to participate in all of the downside.”

Carey adds, “Unlike passive funds, an active manager can choose not to invest; they can hold cash until they see opportunity. That kind of flexibility gives them an advantage because they can wait until the market goes lower to reinvest.”

The COVID-19 pandemic has exposed unexpected vulnerabilities in the U.S. and the world. With the pain inflicted by both the virus and the markets will surely come new opportunities for growth. As with any investment plan, it pays to consider the strengths and weaknesses of any given strategy. When considering an active manager, be sure to check the fund’s active share, which will tell you whether it’s mostly mimicking an index or is truly positioned to add value over its benchmark.

May 04, 2020 at 08:21 AM

May 04, 2020 at 08:21 AM