Costs for long-term care (LTC) can be catastrophic, as can the stress and angst managed when a loved one fails. That loved one might be you, or your client.

If you are hazy on what the difference is between Medicare and Medicaid, or what exactly happens to older people when they’re no longer able to live on their own, then this is something you need to know about.

Certainly, some people have carefully chosen life insurance policies, or annuities designed to help pay for long-term care. Some have stand-alone disability policies that can help, but that can limit out before the need ends. A more recent trend is to attach a long-term care rider to a life insurance policy with combined, “pension benefits” (with loans not taxed as income within IRS compliant policies), and LTC benefits. Premium costs for LTC are competitive, and the policy makes it easier to manage in one place.

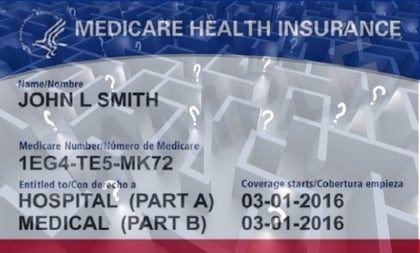

For many new clients, the start of real long-term care cost planning will be learning about what Medicare does not cover.

(Related: What Medicare for All Should Mean to Us)

There are three primary types of Medicare coverage: Original Medicare, Medicare Advantage plan coverage, and Medicare supplemental insurance. Sure, there are dual-eligible patients, who have both Medicare and Medicaid, and dual-insured patients, who have both commercial group insurance and Medicare. There are those lucky few that have an employer medical or LTC policy too, but that is not the story for many.

Some clients might even have stand-alone long-term care policies.

This article, however, focuses on patients who simply have Medicare coverage, not Medicaid, and not commercial health insurance.

Medicare and SNF Care Basics

Long-term care insurance (LTCI) policies, and convalescent care policies, cover “custodial care,” or care that helps people with activities of daily life (ADL’s), such as eating, bathing and other ordinary activities of daily living. LTCI coverage triggers when the insured is unable to perform two or more ADL’s after a waiting period of typically 30-60 days.

Medicare Part A, Medicare Advantage and Medicare Supplemental plans (A-N) do not cover custodial care. It pays only for a limited amount (100 days) of skilled nursing facility (SNF) care, and only if the patient is getting better, not if the patient is disabled and not getting better.

Some “home health” and or SNF services are now insured, but nothing close to what it costs to pay for 24 hour custodial care for bed ridden loved ones. Recent HHS actions now cover new services under Medicare like home (strength and balance) rehabilitation, some meals, and certain in home care that is intended to keep patients out of more expensive hospitals.

Know that SNF’s will do everything possible to get the patient out of their 24 hour facilities within two weeks, so it is important to have a plan of who will care for mom, your spouse, or a loved one.

It is important for your clients to understand their insurance, or risk facing very large uninsured claims for skilled nursing facility care.

My 91-year-old, bed-bound mother-in-law is in a SNF, and her care is $12,000 per month. She got to the facility after 12.5 years of care in our home by my saintly wife. Very few people have prepared for the possibility that they can be disabled for many years, and buy long-term care insurance policies to defend against bankruptcy.

For some families with disabled elderly mothers and fathers who can transport themselves to the bathroom, table, and TV room, an assisted living facility (ALF) is an option. ALF costs are around $6,900 per month. Some facilities can cost less, but provide less comfortable surroundings and staff.

Medical-surgical beds and intensive care unit beds are but two of many bed “types” billed by hospitals.

The bed type billed by the hospital can make, or break if Medicare pays for post-hospital SNF charges.

Medicare rules for triggering SNF coverage eligibility are pretty clear, and knowing them can help a patient avoid bankruptcy. One of the Medicare SNF coverage triggers requires an eligible three-day inpatient stay, prescription for SNF “restorative” (not “custodial”) care. There is no “custodial” long-term care insured in any Medicare policy.

In other words: The patient must be getting better.

February 19, 2020 at 05:22 PM

February 19, 2020 at 05:22 PM