The Bank of England has published a breath-taking thriller for people involved with creating and selling safe saving and investment vehicles: a comprehensive look at what happened to inflation-adjusted interest rates from 1311 through 2018.

Paul Schmelzing, a Harvard University economic history grad student who’s a visiting scholar at the bank, wrote the paper in response to other economists’ and economic historians’ pronouncements that today’s ultra-low interest rates are shocking and sure to go away.

In Europe, many of the ”central banks,” or government banks, that control countries’ money supplies are “paying negative rates of return” on borrowed money. That means, in effect, that investors are actually paying the central banks to store their money safely, rather than the European governments paying the investors to rent their money.

Resources

- A link to Paul Schmelzing’s global real interest rate paper is available here.

Schmelzing dug deeply into economic data archives, in many languages, to come up with the data to show what really happened to interest rates.

(Related: LTC Planning in World History: You Are Here…)

His new paper is the latest version of a case he has been making since 2017.

Here are five takeaways from the paper, for agents who sell life insurance and annuities.

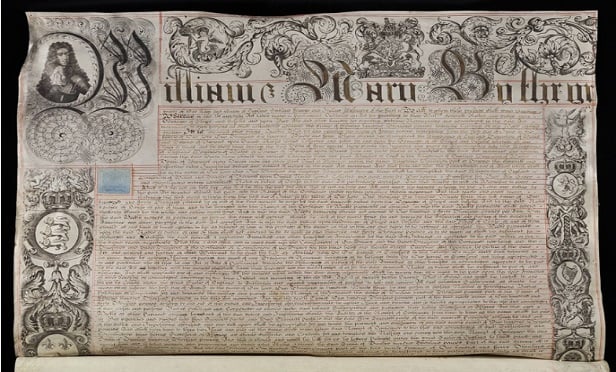

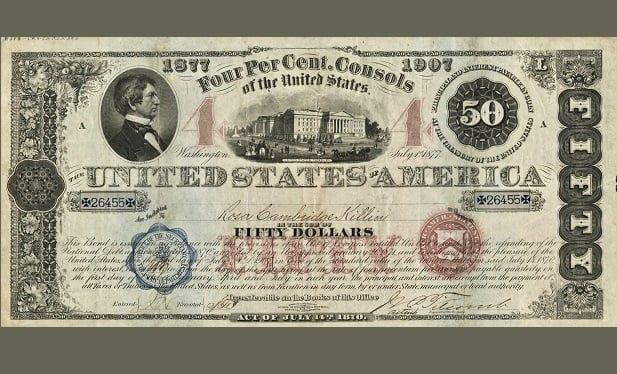

1. The names of the “safe asset providers” have changed somewhat, but there have been ”risk-free” bond issuers and similar sources of “risk-free” savings vehicles since at least 1311.

In the 1300s, the equivalent of the today’s U.S. 10-year Treasury bond was bonds issued by government borrowers in England and in cities in what is now Italy.

2. The safe assets really were safe.

Some very paranoid clients may wonder whether they can even trust the U.S. government to make good on its bond payment promises. The issuers of the bonds and other debt instruments in the Schmelzing made all promised payments, although some issuers delayed interest payments in the 1400s.

3. If only you’d been born in the 1400s.

Annuity sellers then had problems with plague, typhus and bloody wars, but

4. The 2000s looks as if they’re simply continuing a trend.

Schmelzing says the average risk-free inflation-adjusted rate has been about 1.3%. That’s down from 2% in the 1900s, but the average in the 1900s was down from 3.4% in the 1800s, from 3.5% in the 1700s, and from 4.6% in the 1600.s

5. Schmelzing offers no comfort for people hoping inflation-adjusted rates will “return to normal.”

There is no reason, therefore, to expect rates to ‘plateau,’ to suggest that ‘the global neutral rate may settle at around 1% over the medium to long run’, or to proclaim that ‘forecasts that the real rate will remain stuck at or below zero appear unwarranted’ as some have suggested,” Schmelzing writes. “With regards to policy, very low real rates can be expected to become a permanent and protracted monetary policy problem — but my evidence still does not support those that see an eventual return to ‘normalized’ levels however defined.”

In the long run, Schmelzing writes, it looks as if whatever forces are shaping interest rates will continue to shape interest rates, whatever policymakers try to do, because those forces seem to have persisted through all sorts political and economic environments.

Schmelzing does not try to adjust his century

— Read PPACA: A History, on ThinkAdvisor.

— Connect with ThinkAdvisor Life/Health on Facebook, LinkedIn and Twitter.

January 07, 2020 at 03:58 PM

January 07, 2020 at 03:58 PM

Slideshow

Slideshow