September is Life Insurance Awareness Month!

Health insurance is complicated. It’s so complicated that it’s easy to become specialized in just that area and forget the total picture for the client.

(Related: Who Needs Robocalling?)

With the booming gig economy, we have an enormous opportunity to provide not only health insurance for our communities but life insurance as well. So why not consider life insurance part of the health insurance sale?

1. Consumers value life insurance.

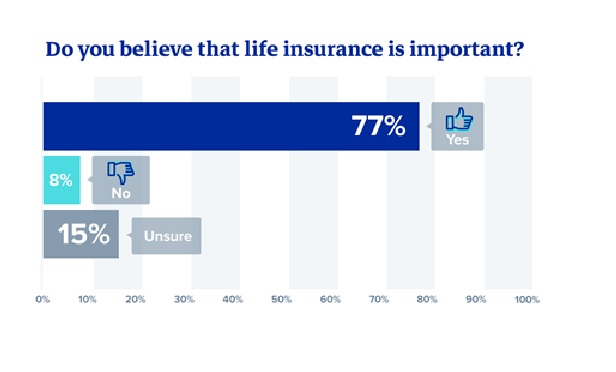

When AgileLifeInsurance conducted a recent survey, 76% of the respondents said “yes” when asked, “Do you believe life insurance is important?”

But 35% of the respondents said “no” when asked if they currently have life insurance.

The lesson here is that there are many consumers who value life insurance in the marketplace and are not covered today.

2. No employer health insurance = no employer life insurance.

Large group employer benefit packages tend to be rich in benefits like health insurance, life insurance and other benefits. However, smaller employers typically cannot afford to provide all of the benefits of a large employer, so clients who are seeking health insurance have a high likelihood of needing a life insurance solution as well.

3. Affordable options help consumers.

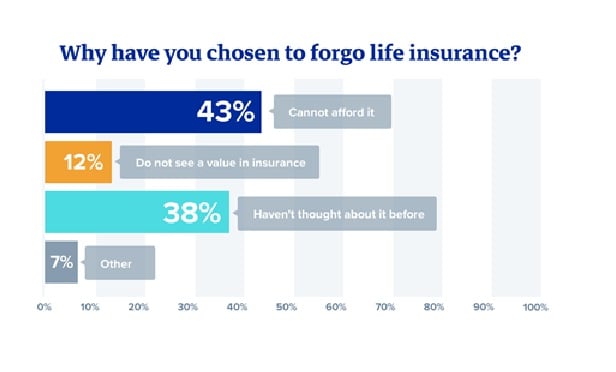

Like the health insurance marketplace where price can drive the decision of which product suits a consumer’s budget, price is a driver in the life insurance marketplace. In the AgileLifeInsurance survey, of those who do not have insurance, 43% responded that they were uninsured because of lack of affordability. For clients seeking an low-cost solution, a term life insurance policy may be a great option to provide an affordable product. For other clients, who have greater needs, a higher cost whole life product may be the right fit, depending on the situation.

4. Education is key.

Interestingly, 37% of those who haven’t purchased life insurance said they don’t have coverage because, “They haven’t thought about it before.” Educating consumers is how licensed agents can provide the greatest value for their clients. If there are clients who would benefit from the opportunity to consider life insurance, then we should take the opportunity to provide the information and help the clients make the best decisions for them and their families.

5. It’s the right thing to do.

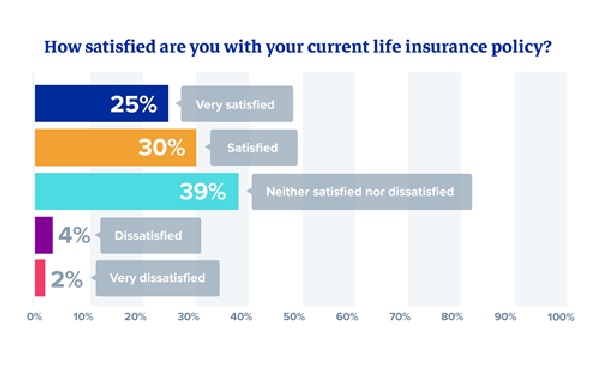

Life insurance offers financial support that can be comforting in times of need. Purchasing life insurance is a gift to the family members left behind to help with the loss of the loved one. Life insurance can cover funeral expenses, unpaid medical bills, mortgages, college education and more. About 94% of the survey respondents report being either very satisfied, satisfied or neutral about their current life insurance policies, demonstrating that clients who have life insurance are happy with their coverage.

While you may find it tempting to specialize in the complexity of health insurance, take a moment to remember that September is Life Insurance Awareness Month. There are many clients who would benefit from learning more about life insurance and how it can help them.

— Connect with ThinkAdvisor Life/Health on LinkedIn and Twitter.

Jan Dubauskas serves as vice president and senior counsel at Health Insurance Innovations Inc., which is a distributor of life and health insurance products and the parent of AgileLifeInsurance.com.

September 24, 2019 at 11:33 PM

September 24, 2019 at 11:33 PM

Slideshow

Slideshow